Modern organisations can no longer ignore the buzz around ESG. Short for Environmental, Social and Governance, ESG is a reaction to Milton Friedman’s 1970s credo that the social responsibility of business is to increase profits. But far too many examples today show how this narrow definition of social responsibility has negatively impacted employees, local communities and/or the environment – all of which are stakeholders.

Failing to consider these stakeholders threatens sustainable business models. Combatting that threat, ESG aims to consider all stakeholders in the company. And OneStream’s capabilities for ESG reporting & planning ensure that trusted information can be effectively available as and when required. But before we dive into all of that, let’s first review the benefits of ESG and the bidirectional relationship between organisation and climate.

The Benefits of ESG

Research shows that ESG pays off. How? It makes companies more resilient in times of change. The interrupted supply chains during the pandemic offer the perfect example. Companies that invested in trusted relations with suppliers and employees got production back on track faster and grew faster than companies without those relations.

Not convinced? Well, then consider the following.

Growing demand for sustainable investments, a market estimated to reach $34 trillion in 2026, runs rampant today. Within that environment, fund managers must consider demands like zero emissions/zero pollution, no child labour, equal opportunities and much more throughout the entire value chain of portfolio assets.

These considerations require data, typically non-financial data, and the quality of that data is questionable at best. Using that data leaves asset managers facing the risk that their green funds or equality portfolios contain some rotten eggs. And just around the corner lies greenwashing and other types of reputational damage.

At the same time, governments across the globe want to accelerate the transition to renewable energy. The EU Green Deal, the US Inflation Reduction Act and similar transition programs in other parts of the world all aim to support private investments in green technology – with massive amounts of public money. Yet these governments face a big challenge: How can governments ensure they’re supporting truly green technology and not just some repackaged old tech?

So again, data of questionable quality is an issue. How, then, can anyone trust the data quality? Governments have an advantage here: they have regulatory bodies. What do they do for ESG? They regulate it. The US-SEC has issued drafts that are expected to become law as of FY 2024. In November 2022, the EU parliament voted for the CSRD, which will also become mandatory starting in FY 2024 for the first cohort of companies. Other jurisdictions (e.g., UK, ANZ, Singapore, SA) have passed or will soon pass similar legislation.

Using quantitative and qualitative data to report on environmental and social topics, combined with governance, will ensure policies are in place and anchored throughout the company, all the way up to the executive level. This process is a huge undertaking for companies. It’s a journey. Some companies have been on this journey for 15-20 years. Others are just getting started.

This topic is expansive, but a blog post is not an essay. To stay mindful of your time, let’s just zoom in on energy transition and the resulting focus on climate change as part of the larger environmental topic.

The Bidirectional Interaction Between Organisation and Climate

Through their activities, organisations impact the environments in which they operate, and organisations’ emissions of greenhouse gases (GHGs) potentially impact climate change. Organisations can make choices to reduce that impact, however. So when organisations claim a desire to become NetZero by 2035, they need to make choices that achieve that goal.

The consequences of not taking action on emissions can negatively impact the business model of a organisation. When making decisions for the future, organisations should therefore consider the related risks and opportunities of climate change.

See the similarities with Finance? With setting financial targets and reporting on progress. With identifying opportunities and mitigating risks that impact the future capabilities to make a profit. These steps are what financial outlooks are all about. Similar to financial outlooks, financial markets discount the resilience to climate change and other ESG performance metrics in the stock price of a company.

How can Organisations ensure they are prepared for this journey?

Why OneStream for ESG Reporting & Planning

For many organisations, the area of ESG is new. And data quality is poor. Organisations must account not only for their own operations but also for their entire value chains. That combination creates a massive puzzle of data with which many organisations struggle. Some say that the regulatory part is perhaps the ‘easy’ part. How to get reliable data from all suppliers is a much bigger challenge. And how to plan the roadmap towards a Net Zero commitment for 2035 is also a significant challenge.

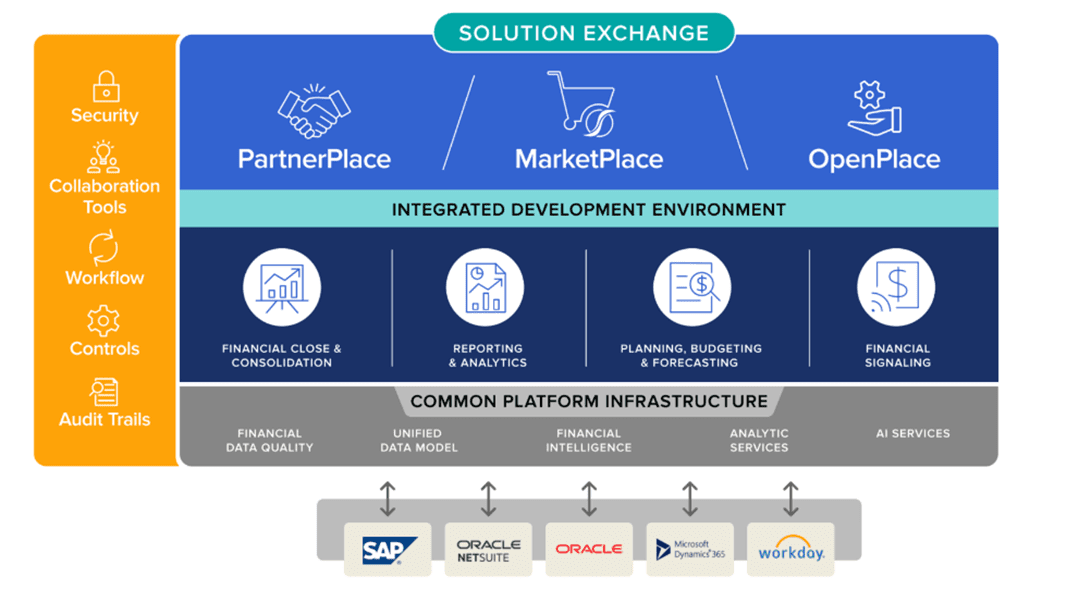

Data quality will thus undoubtedly be a main topic for years to come. And the OneStream platform has proven to be of great value for managing data quality (see Figure 1) . At OneStream, our data integration engine, our workflows, our consolidation and our task audit capabilities are exactly what organisations need to get on top of data quality.

But how can organisations report on ESG performance in a meaningful way? By aligning it with financial performance. The other part of our claim for ESG is therefore that companies must align ESG reporting & planning with their financial reporting and planning by…

- Allowing leadership to make decisions on financial and ESG criteria.

- Reporting on performance in a consistent, easy-to-understand way for the financial markets and other stakeholders.

- Generating reports and analyses that speak the language of the board and provide a solid basis for the company’s strategy.

How does OneStream do all of that? Those familiar with our platform know we’re recognised as the market leader when it comes to data quality, reporting, planning and more. That means the platform, just as it is, can also handle the challenges in ESG reporting & planning (see Figure 2). And we have customers who are already doing their ESG reporting on OneStream today.

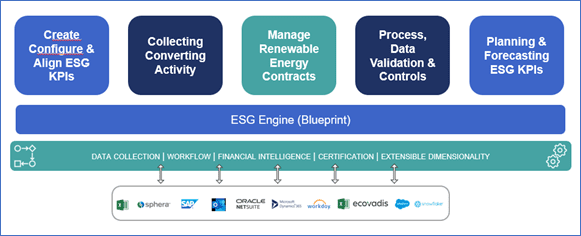

The OneStream ESG Blueprint

How can the release of our ESG Blueprint solution (included in your OneStream license) help your organization? In short, you can accelerate your ESG reporting in OneStream. The blueprint adds auditable carbon calculations with pre-configured metadata, business rules and data tables to support your Scope 1 and 2 emissions. Apply the emission factors of your choice, and let OneStream handle your contracts for renewable energy (RECs, PPAs) to calculate your location and market method. Then, combine ESG and financial data into intensity metrics that show the development towards your emission goals.

In the ESG Blueprint, you can enter activity (e.g., fuel consumption, electricity usage) or distance (by vehicle type). The blueprint then applies factors to convert this input into carbon dioxide equivalent (CO2e), the common denominator for global warming potential. The solution also converts the common types of refrigerants into CO2e.

You can slice and dice your emissions data (See Figure 3) in the same way you do your financials (e.g., by region, product, business area, etc.). Extensible Dimensionality provides your ESG data model with the structures you defined for your financial model. From there, you can extend the ESG model with more granularity – for example, by location (factory, warehouse, mine, office) or asset class (e.g., vehicle type). And you can do it all with single point of maintenance and full control.

Plus, the calculations in the ESG Blueprint are fully transparent and auditable. The solution comes with a set of reports that check the consistency of the data model – ensuring your organisation can report and plan ESG with full confidence.

Learn More

To learn more, read our ESG Whitepaper or check out the blog posts in our ESG series. And if your organisation is ready to align ESG reporting & planning with financial reporting and get ahead of the upcoming disclosure mandates, contact OneStream today to get started.

Get Started With a Personal Demo