Just when some light seemingly appeared at the end of the tunnel as the global pandemic waned, 2022 proved to be a challenging year for both individuals and corporations thanks to a host of other reasons. Geo-political instability due to the war in Ukraine led the headlines for most of the year. But higher fuel prices, widespread inflation, continued supply chain bottlenecks, rising interest rates and falling financial markets all played a role, too. With planning and budgeting season here, what assumptions are CFOs and Finance executives making about what lies ahead in 2023? And how are those assumptions impacting corporate planning?

For the past few years, OneStream Software has sponsored Hanover Research surveys of Finance executives to better understand how they’re helping their organizations navigate the complexities of today’s economic landscape. Hanover Research recently surveyed over 650 financial decision-makers in North America, as well as EMEA, to understand their expectations for 2023.

The survey asked about decision-maker’s expectations regarding inflation, a potential recession, supply chain disruptions, talent management, Environmental, Social & Governance (ESG) and Diversity, Equity & Inclusion (DEI) initiatives, and technology investments.

Here’s a summary of what we learned from the 2022 Hanover Research Finance Decision-Makers survey.

Key Objectives of the Survey

- How have financial decision-makers responded to economic changes and the COVID-19 pandemic?

- What outlooks do financial decision-makers have toward the post-COVID recovery?

- What have decision-makers’ companies done to invest in and attract talent during The Great Resignation? What tools are companies using?

- What is the outlook of the future financial landscape among decision-makers, and what steps are they taking? What tools do decision-makers plan to adopt, if any?

Recommendations for Financial Decision-Makers

The takeaways from the report emphasized renewed enthusiasm towards machine learning (ML) and its impact on organizational performance. Increased economic uncertainty has emergedin recent months (e.g., inflation, tax reform, supply chain shortages, the lingering effects of the COVID-19 pandemic and a potential recession). Amid that environment, businesses continue to reallocate spending within their businesses.

Key Findings Every CFO Should Know

- Economic disruptions are seen as the biggest risk to businesses in 2023. Price increases are the number-one way businesses have dealt with inflation (56%), followed by slowed hiring or reduced specific operational costs (47%). Meanwhile, half of the businesses are reducing corporate spending and updating tax planning and provisions to prepare for updated tax reforms (both 53%).

- Three-quarters of financial leaders expect inflation and the fear of recession to continue until mid-2023 or later and COVID-19-related supply chain disruptions to continue into 2023. Most businesses have already altered financial forecasts and strategies in anticipation of an impending recession (85%), and almost two-thirds of businesses (64%) expect a recession to last until late 2023 or beyond, mirroring the projected inflation timelines.

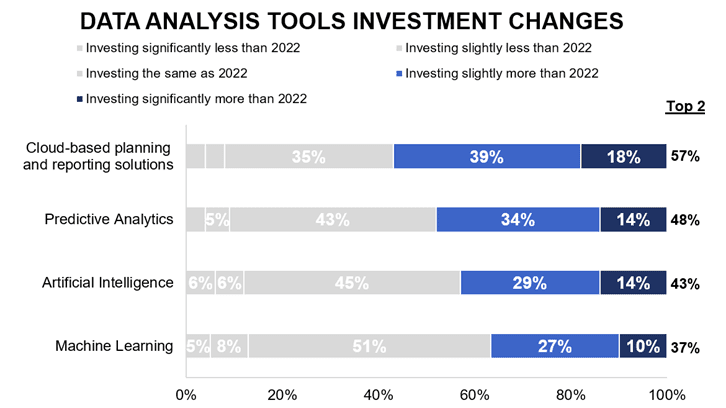

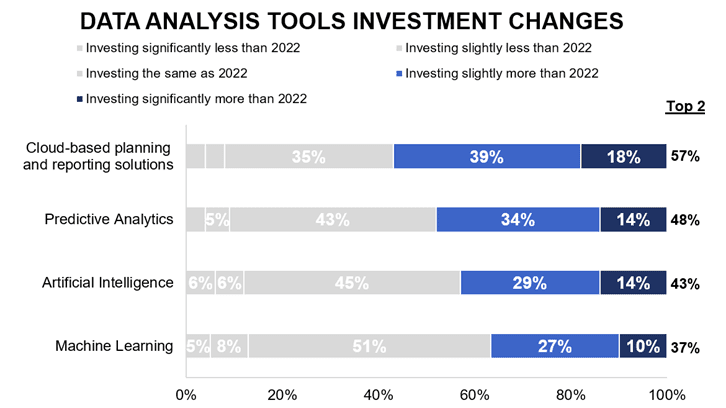

- Additionally, although costs & budget support are seen as the biggest obstacle to investing in new technologies, financial leaders also anticipate greater investment in data analysis tools in 2023. Currently, most (90%) businesses regularly (61%) or intermittently (29%) use cloud-based budgeting and planning and reporting solutions. A little under two-thirds (64%) use machine learning regularly (20%) or intermittently (43%).

- Specifically, a quarter of businesses (28%) have already adopted automated machine learning (AutoML) while half (48%) plan to adopt it in the future. Financial leaders see financial reporting as the top opportunity for using AutoML (48%).

Stormy Economic Conditions Ahead

With inflation continuing to plague both individuals and enterprises, price increases are the number-one way businesses have addressed inflation (56%), followed by slowed hiring or reduced specific operational costs (47%) (see Figure 1).

Almost half of businesses have slowed hiring or reduced specific operational costs, another significant increase from a year ago.

When asked how long they expect inflation to persist, three-quarters of financial leaders do not expect inflation to slow down until mid-2023 or later. This group includes one-fifth (20%) who do not expect inflation to slow down until 2024 or later, representing a shifting timeline. Last fall, half (54%) believed inflation would stabilize by the end of 2022, and earlier in 2023, under half (47%) expected inflation to slow in mid-2023 or later.

Investment in Cloud Planning and Analysis Tools Increasing

Over two-thirds of businesses regularly use cloud-based planning and reporting, and one in five (20%) report regularly using machine learning within their departments. Looking forward, over half of financial leaders predict investing more in cloud-based solutions.

Meanwhile, only one-third of companies (37%) predict investing more in machine learning, which is significantly fewer companies than predicted both last fall and earlier in 2023 (see Figure 2).

When asked about the top use cases for artificial intelligence or machine learning, financial leaders surprisingly identified financial reporting as the top opportunity in the fall 2022 survey. The financial reporting use case was followed by sales/revenue forecasting (41%) and demand planning (39%) as the second and third largest opportunities for organizations, respectively (see Figure 3).

DEI and ESG Initiatives Still in Focus

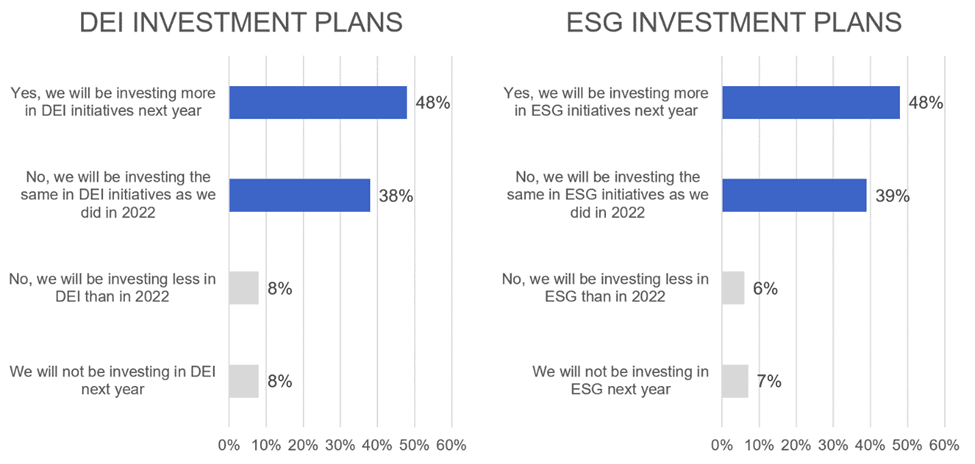

With ESG reporting guidelines converging and new mandatory disclosure requirements being proposed by the US SEC and regulators in other countries, investments in ESG and DEI remain a priority. Half of the organizations surveyed expect to invest more in DEI and ESG goals and initiatives in 2023 compared to 2022 investments. This change is a significant drop compared to expectations from earlier in 2023 (65% in DEI and 60% in ESG). Still, over a third of enterprises expect to maintain their 2022 investment levels in both DEI and ESG in 2023 (38% and 39%, respectively) (see Figure 4).

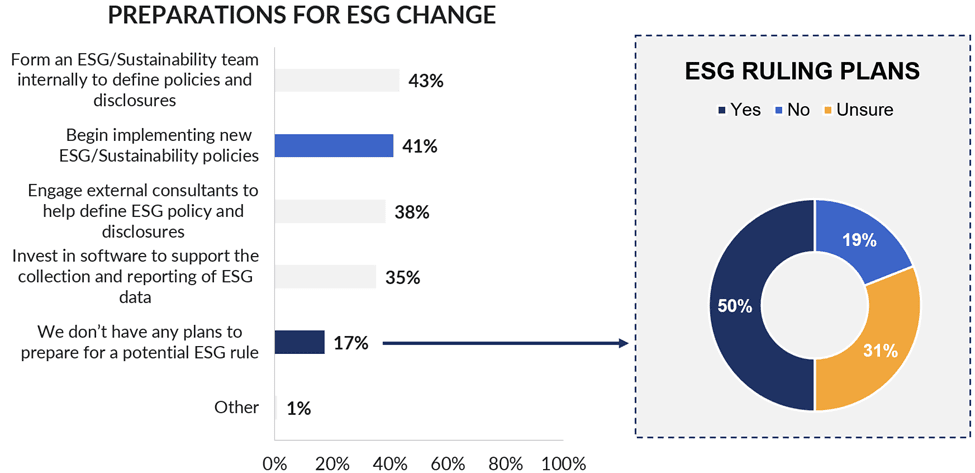

When asked about their plans to prepare for changing ESG Reporting requirements, nearly half of the financial executives surveyed have started or plan to start forming an internal ESG/Sustainability team to define policies and disclosures. A similar proportion (41%) will begin (or have already begun) implementing new ESG/sustainability policies. Compared to earlier in 2022, fewer are planning to invest in software to support ESG data collection and reporting. Among those who currently don’t have a plan in place, half (50%) indicate they may implement a plan if ESG reporting mandates impact their organizations (see Figure 5).

Conclusion

The results of the recent Financial Decision-Makers Survey highlight the ongoing business challenges CFOs and Finance leaders face as they look to drive performance ahead in 2023. Inflation, higher interest rates, supply chain bottlenecks and recession are here to stay, and most Finance executives expect those challenges to continue into 2023.

The good news is that today’s cloud-based analytical software technologies are seeing increased adoption and proving their worth in helping Finance teams become more efficient, plan and navigate a volatile economic landscape, and increase their agility to respond. Artificial intelligence and machine learning adoption still lag behind mainstream planning and predictive analytics tools. But as these capabilities are embedded into modern planning, reporting and analytical software applications, Finance adoption is poised to expand rapidly.

Learn More

This report delves into the latest trends in modern planning, reporting and analytics software applications, from predictive analytics to artificial intelligence and machine learning. And with expert insights from leading CFOs, you’ll gain valuable knowledge and actionable strategies to stay ahead of the game with more effective planning and budgeting.

To learn more,– download our CFO Executive Outlook Report today to gain a competitive edge in 2023.

Get Started With a Personal Demo