Intercompany reconciliations are a key step in the creation of consolidated financial statements. The objective is to ensure the consolidated financial statements present an accurate picture of revenues, expenses, assets, liabilities, and equity – ensuring they aren’t inflated due to transactions occurring between subsidiaries or companies in the group.

Several types of intercompany (IC) reconciliations must occur to ensure the accuracy of consolidated financial statements. Some examples are;

- Intercompany revenue and expenses: The intercompany elimination of the sale of goods or services from one entity to another within the enterprise or group. The related revenues, cost of goods sold, and profits must all be eliminated.

- Intercompany debt: The intercompany elimination of any loans made from one entity to another within the enterprise or group since they only result in offsetting notes payable and receivable, and offsetting interest expense and interest income.

- Intercompany stock ownership: The intercompany elimination of the parent company’s ownership interest in its subsidiaries, or ownership across subsidiaries.

For sophisticated organizations, intercompany transaction volume can be significant and difficult to identify. To ensure all this activity is identified, eliminated, and documented correctly for auditors requires a detailed system of controls. Managing and eliminating intercompany activity via Excel spreadsheets and email is not a recommended approach for large global enterprises with a significant number of IC transactions.

Not All Consolidation Software Is Equal

Most financial consolidation software packages provide core functionality to address requirements, such as currency translation, intercompany reconciliations, journal adjustments and partial ownership of entities. But not all packages are created equal – not all of them provide the same level of functionality in each area, and they may utilize different approaches to intercompany reconciliations.

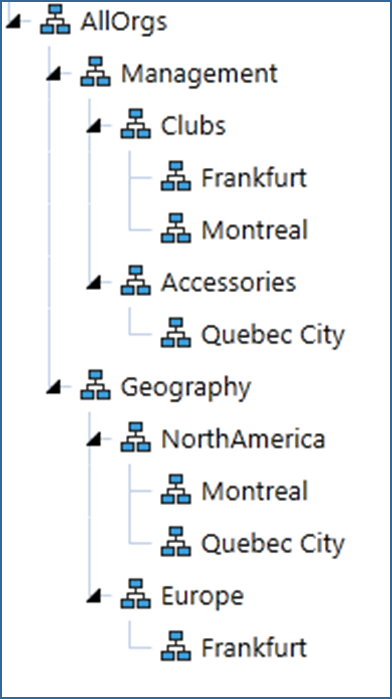

One example is the requirement to write custom business rules to consolidate data vs. using a consolidation hierarchy. Software packages that require custom business rules to consolidate data require more work to set up initially and to maintain going forward. The use of consolidation hierarchies, however, makes the system easier to configure and maintain for both single and multiple consolidation hierarchies.

Another example is the use of “elimination entities” vs. an intercompany dimension to identify and manage intercompany reconciliations across existing entities. Software packages that rely on creating multiple elimination entities to capture IC activity require more work to set up and maintain. The better approach is systems that leverage an IC dimension to identify, match and analyze intercompany transactions between existing entities and an elimination member to capture direct and indirect eliminations to make sure they never disappear as they eliminate up the consolidation hierarchy.

Also, when IC entities are used, users lose visibility into the individual intercompany balances and only see the totals in the IC entities. This makes it difficult to understand the where the out of balance condition resides, and what needs to be addressed and by what party. An IC dimension captures all party-counter-party balances and provides complete visibility into what is in and out of balance. This allows business users to identify and correct the discrepancies quickly and easily.

Another example is systems that actually store consolidated balances and intercompany elimination entries in a database vs. those that only consolidate and expose intercompany eliminations when reports are run.

Systems that store consolidated data and intercompany elimination entries in a database provide a big advantage when auditing financial statements – detailing the original source of the data, currency translations, eliminations and any other adjustments that resulted in the consolidated accounts. Systems that calculate and consolidate data only when reports are run are less trusted by auditors since the numbers can change and there is no record of what the number was previously.

And yet another approach is systems that duplicate base entities and their data vs. those that leverage a single shared base entity that can be rolled up in infinite hierarchies – for example, to consolidate based on a management view of the organization vs. a legal or statutory view. The former approach requires the administrator to identify IC relationships in each entity structure vs. setting this up and managing it in one place. The risk of this approach is that it requires the administrator to ensure the data which has been loaded multiple times is the same each time it is loaded.

If you’re considering a financial consolidation system, you should be asking these questions:

- How simple is it to set up basic intercompany reconciliations?

- Can the system handle complex eliminations?

- How robust is the reporting?

- Are eliminations handled at the first common parent or at some other level?

- How simple is a reorganization?

The OneStream Approach to Intercompany Reconciliations

The good news is, there is a better approach. Enterprise-class consolidation software applications provide intercompany eliminations that are powerful enough to handle sophisticated business needs yet allow for easy reconciliation.

The OneStream team has developed the most advanced financial consolidation, reporting and data quality solution in the market. This includes providing powerful intercompany elimination capabilities that can handle sophisticated business needs yet allow for easy reconciliation.

To improve and streamline the management of complex intercompany reconciliations, OneStream’s Intelligent Finance platform includes:

- Prebuilt and easily configurable dimensions

- Ability to handle the most sophisticated intercompany eliminations

- Ability to dynamically limit entry to avoid mistakes

- Multiple prebuilt and custom report options to help users proactively communicate and resolve issues

Combined with OneStream’s ability to drill down into transactional details and relational blending capabilities, OneStream provides an unmatched ability to see and manage intercompany activity.

With well-designed, pre-built and easily customizable dimensions, OneStream consolidates data based on organizational hierarchies and automatically eliminates intercompany transactions and balances at the first common parent – in all hierarchies (e.g., management, legal, tax, etc.) This is done without the creation of specific intercompany elimination rules or relationships within hierarchies, which makes the system much easier to maintain vs. other systems in the market.

Plus, OneStream has an incredibly powerful rules engine that will address any exceptions or more complex eliminations. Here are some of the common eliminations that require rules:

- Investments in subsidiaries

- Profit in inventory eliminations

- Certain statutory eliminations

The configuration of these eliminations allows for something very powerful if you ever have to reorganize the company structure. You can simply move the entities and reconsolidate – done!

The Secret Sauce in OneStream

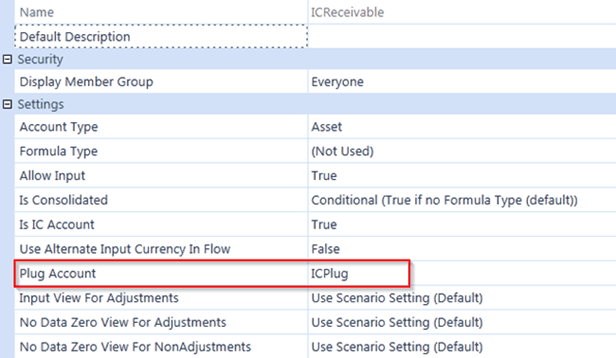

OneStream includes a number of pre-built dimensions that provide the power to handle sophisticated financial consolidation and elimination requirements. Specifically, OneStream uses the Account, the Intercompany and the Origin dimension to process IC matching and eliminations. This functionality does the following:

- Matches values between IC accounts that share a common suspense account (a.k.a. plug account)

- Automatically creates eliminations at the proper entity levels for each IC account

- Writes unresolved differences into the specified suspense account (plug account)

This functionality creates something called the “first common parent rule.” That means the eliminations are calculated at every consolidation point. Each intercompany has an “in and out” – for example, when you match a receivable and payable, they both offset through a common account.

Some consolidation applications will try to calculate IC eliminations at base entities. Others will require users to recreate eliminations for each rollup of entities. The most powerful applications all have “first common parent functionality.” It’s a basic requirement.

For each eliminating IC transaction, OneStream will create both sides of the entry that offsets the data value from the IC account and IC partner. That offsetting amount is written to the plug account. If the entries do in fact match, then the debit and credit for each side of the intercompany match would net to zero.

For example, if you had one entity with an IC payable and one with an IC receivable, when each entity reaches the common parent, when the elimination should take place, there’s an entry in the Origin dimension for that account that offsets the amount in the account that requires eliminating. At the same time, OneStream also writes a value for each offset it created, to the suspense account or plug account.

Setting this up is simple. Each IC account must be flagged for intercompany, each entity that is booking IC activity must be flagged and, finally, each combination of IC matching counts must have a corresponding plug account.

The IC dimension represents the IC Partners, which as an originating entity can post an entry against (for Intercompany flagged accounts). This is a reserved dimension that’s used by OneStream to track and eliminate intercompany details across the Account dimension and related User Defined dimensions.

Some features simplify the process out of the box – for example, the ability to limit the intercompany partner so that they must either enter a partner or not choose themselves.

While the settings address most basic eliminations, OneStream has an incredibly powerful rules engine that will address any exceptions or more complex eliminations. Here are some of the common eliminations that require rules:

- Investments in subsidiaries

- Profit in inventory eliminations

- Certain statutory eliminations

These are often not supported at all in other consolidation applications.

The configuration of these eliminations allows for something very powerful if you ever have to reorganize the company structure. You can simply move the entities and reconsolidate – done! Any system that’s using journals or manual entries or that doesn’t have shared members – will require significant work to accomplish this type of change.

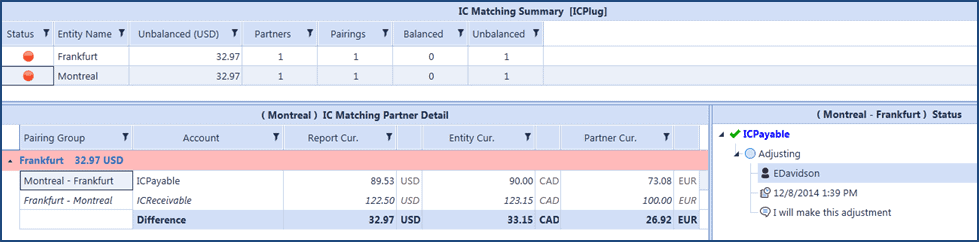

Reporting on Intercompany Activity

In addition to the capabilities described above, there are some great reports that are ready to view “right out of the box” with OneStream. For example, OneStream has a focused intercompany elimination “grid” that appears in the workflow. This allows users to comment and communicate with other users regarding intercompany balances.

The power of these IC system reports is that they ignore security for the intercompany accounts. This feature helps get users to take ownership of the intercompany matching process, by allowing each intercompany trading partner to see matching balances across entities, and in multiple currencies.

The advanced architectural design of OneStream, combined with its reporting and the ability for users to drill down into transactional details, provides an unmatched ability to see and resolve intercompany balances and rapidly close the books at period-end.

Learn More

Are you considering a financial consolidation and reporting platform to help your company manage complex intercompany activity? Check out our video on automating intercompany. To learn how one of our customers is benefiting from these advanced capabilities, check out the Alterra Mountain Company case study.

If you’re ready to learn more about the power of an Intelligent Finance platform, contact us today to take a deeper look at the OneStream approach to handling intercompany reconciliations.

Learn MoreGet Started With a Personal Demo