For decades, organizations worldwide have relied on SAP BPC (Business Planning and Consolidation) for their financial consolidation and planning needs. However, at the time of writing this article, the end of support for SAP BPC has been updated and set for 2030 but has been a moving target. Organizations are now proactively exploring SAP BPC alternatives that go beyond simply matching SAP BPC capabilities to finally deliver on the promise of one source of truth. What’s needed to deliver it? Unifying the full consolidation and close lifecycle and financial & operational planning, with built-in dashboarding, reporting and analysis, from the balance to the transaction level.

What exactly does the post-SAP BPC landscape have to offer? Let’s take a closer look at five of the top SAP BPC alternatives and competitors. In this article, we’ll discuss not only key features and capabilities, but also any potential drawbacks or limitations for each alternative – to give you the information needed to make an informed decision about the right SAP BPC alternative for your organization.

What Is SAP BPC?

SAP BPC is a solution developed by former Hyperion Solutions employees after the acquisition/merger of Hyperion Solutions and Arbor Software (Essbase). By design, the solution was developed to bring together consolidations and planning into one Excel-based interface to ensure familiarity among Finance professionals. SAP BPC had built-in financial intelligence to streamline consolidations so that Finance could produce consolidated Profit & Loss, Balance Sheet and Cash Flow statements.

More specifically, financial intelligence meant the solution had currency translations, intercompany eliminations and account attributes to ensure an account behaved correctly when consolidating and across time.

Customers liked SAP BPC for three main reasons:

- Its built-in financial intelligence

- The familiarity and flexibility of an Excel-based interface

- The promise of having all consolidation and planning processes in a single solution

However, SAP BPC never delivered on the promise of one solution. Most customers needed to manage business-level differences in consolidation granularity and different levels of granularity for planning from actuals (i.e., strategic plans at a summary level, budgets and forecasts at a lower level, and actuals at a detailed level), but still reconcile with actuals for analysis and reporting. To achieve that, most customers would have separate consolidation applications and planning applications. These applications would then need to be integrated, and often, additional applications were needed to bring everything together for analysis and variance reporting.

Under SAP, BPC moved away from the standard Excel-based interface by making it more web enabled. SAP migrated BPC to work on SAP NetWeaver and S/4 Hana on-premise, in addition to the original Microsoft platform. The result? Added complexities in the form of multiple back-ends, clunky interfaces and complex integrations – resulting in cost and duplication of data and metadata, time-consuming processes, and upgrades.

With the SAP BPC end of support now set for 2030, many organizations have either already selected alternatives or are in various stages of selection processes to find SAP BPC competitors. What alternatives should you consider based on your business needs? Let’s review the top options to help you find the right solution.

5 Best SAP BPC Alternatives

Given the 2030 end of support date for SAP BPC, this article gives an overview of the five best Corporate Performance Management (CPM)/Enterprise Performance Management (EPM) solutions. The selected solutions are ideal for enterprises looking to replace SAP BPC with something that delivers on the promise of a unified platform for consolidation, close, and financial & operational planning.

To produce this list, we evaluated numerous reviews and analyst reports, which are the typical starting point for CPM/EPM selection processes. We then evaluated alternatives based on five key criteria:

- End-to-end management of enterprise-wide consolidation, close, and financial & operational planning and forecasting

- Built-in data quality engine, in the hands of Finance, providing a strong flexible foundation in integration and data quality

- Ultimate agility to adapt to varying levels of granularity in the business and across consolidation, planning and forecasting processes

- Optimized end-user experience to drive efficiency and effectiveness, eliminating time-consuming and error-prone manual processes

- Trusted insights – from balance to transaction level for transparency, auditability and actionable details behind every number

Now let’s dive into the details of the top five options for an SAP BPC alternative, including a quick look at the pros and cons of each.

1. OneStream

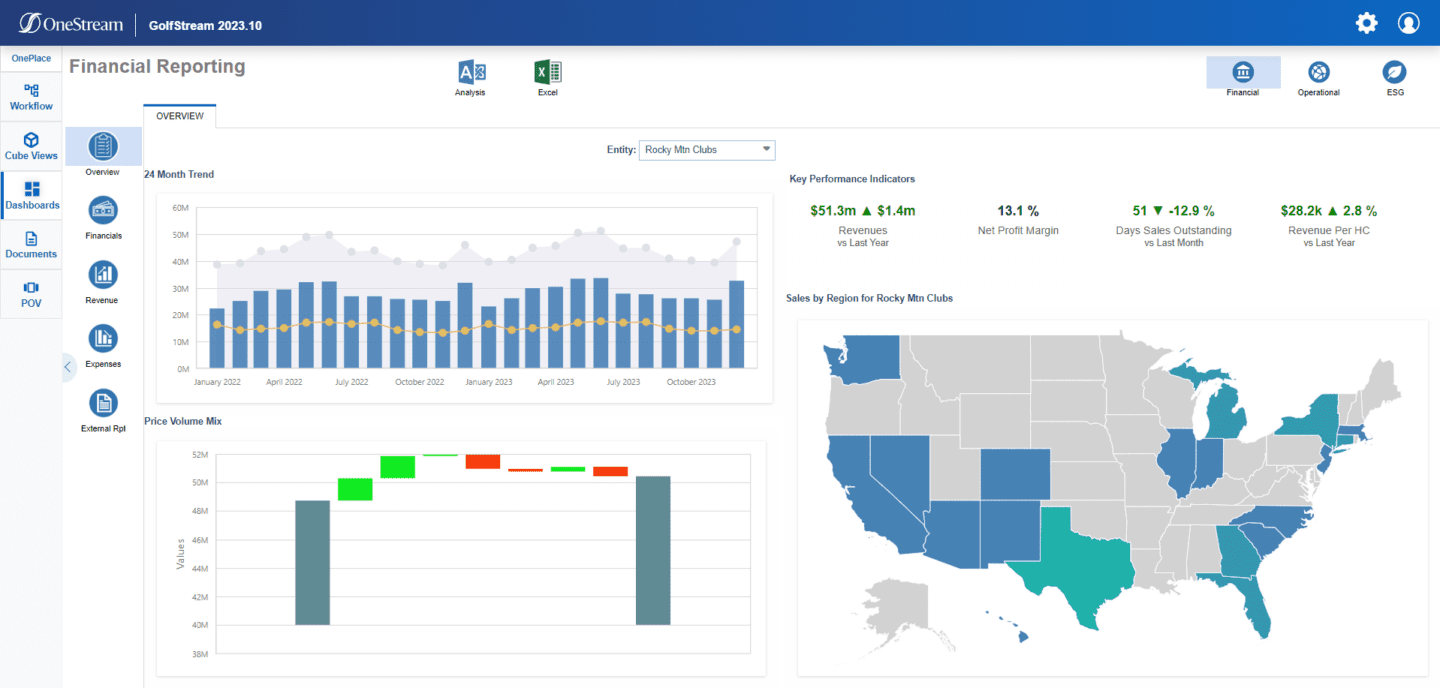

OneStream is the only solution for CPM/EPM that delivers end-to-end management of enterprise-wide consolidation, close, and financial & operational planning and forecasting in a unified platform. This unified platform enables Finance and Operations teams to better collaborate and deliver a single source of truth. Having that single source eliminates the complexity of multiple solutions, interfaces and integrations; heavy cost and duplication of data and metadata; and time-consuming processes and upgrades.

With OneStream’s built-in data quality engine and pre-built connectors, Finance is in control, providing a strong, flexible foundation in data quality that’s ERP and source system agnostic, as real-time as needed, with drill down and drill back to any source. Those capabilities provide not only auditability across all close, planning, reporting and analysis processes, but also actionable insights behind every number.

Guided workflows and task management provide standard, defined and repeatable close, planning and operational processes. These capabilities simplify complexity for business users by guiding them through all data management, data collection, verification, approval, certification, locking, reporting and analysis processes. This ensures operational relevance and direct reconciliation for all processes, regardless of different levels of granularity across businesses and scenarios. OneStream also eliminates the need to implement and integrate multiple solutions, delivering confidence and reliability in all business user-driven processes.

Pros:

- One EPM solution owned by Finance for end-to-end management of enterprise-wide consolidation, close, financial & operational planning and forecasting, reporting, and analysis – eliminating the complexity of multiple solutions and ensuring direct reconciliation of actuals, plans and forecasts without the cost, complexity and duplication of data and metadata

- Built-in data quality engine, providing a strong flexible foundation in integration and data quality to deliver confidence, trust and, finally, a real one source of truth

- Ultimate agility to ensure direct reconciliation of actuals, plans and forecasts leveraging the unique innovation of Extensible Dimensionality®, to deliver both operational relevance and adaptability. This capability means lines of business and actuals and plans with different granularity can live and reconcile in the same application without complex administration or falling back to Excel for offline models

- Optimized end-user experience to drive consolidation, close, and financial & operational planning process efficiency and effectiveness, eliminating time-consuming and error-prone manual processes

- Built-in self-service reporting, dashboarding, ad-hoc analysis and deep integration with Microsoft Office in one platform, from balance to transactional details with seamless drill down and drill back to supporting details for transparency, auditability and actionable details behind every number

Cons:

- Best for enterprises looking for end-to-end management of enterprise-wide consolidation, close, financial & operational planning and forecasting, reporting, and analysis in a unified platform. For small to medium-sized organizations not looking for this unification, even though OneStream is user-friendly, mastering the design and advanced features may pose a slight learning curve

- Despite growing popularity and 100% customer success of over 1,300+ customers, OneStream may have a smaller market presence compared to other alternatives

2. SAP EPM

With the end of support for SAP BPC set for 2030, SAP’s go-forward solutions for EPM are a combination of SAP Group Reporting embedded in S/4HANA for consolidations and SAP Analytics Cloud for financial and operational planning.

SAP S/4HANA Group Reporting is an enterprise solution for consolidations. As part of S/4HANA, the Group Reporting solution leverages a combination of features tied to Group Reporting for consolidations and S/4HANA for core close capabilities. SAP Analytics Cloud (SAC) is a cloud-based platform for planning, business intelligence (BI) and predictive analytics that enables organizations to visualize, plan and make data-driven decisions.

Pros:

- Both Group Reporting and SAC solutions run on the same S/4HANA technology to streamline integration with SAP ERP systems, making them a good choice for organizations deeply embedded in the SAP ecosystem

- SAC offers flexibility in modeling and reporting, catering to diverse business needs

- SAP customers benefit from SAP’s global footprint, ensuring access to a vast pool of skilled professionals and SAP domain knowledge

Cons:

- A lack of parity exists in Group Reporting for the consolidation capabilities customers were accustomed to in BPC, especially for complex global statutory consolidations

- Customers will need to implement S/4HANA and upgrades can be challenging with known impacts on the agility Finance needs to change to Group Reporting for close and consolidation processes

- Although both Group Reporting and SAC use the same underlying technology, they are still separate solutions. Each requiring its own implementation, ongoing maintenance, and multiple complex integrations across solutions to reconcile actuals with plans and to bring in non-SAP financial and operational data to support the end-to-end EPM processes

3. Oracle EPM

Oracle EPM is a suite of business applications designed for end-to-end management of enterprise-wide consolidation, close, financial planning & forecasting, and performance reporting. Oracle closely resembles SAP, with legacy solutions from the acquisition of Hyperion also ending support in 2031 for Hyperion HFM and Hyperion Planning. The Oracle suite of applications is being redeveloped on the Cloud, consisting of individual best-of-breed solutions for the following:

- Consolidation & Close

- Financial Consolidation and Close (Formerly FCCS)

- Account Reconciliations (Formerly ARCS)

- Tax Reporting (Formerly TRCS)

- Planning & Profitability

- Planning (Formerly EPBCS)

- Profitability and Cost Management (Formerly PCMCS)

- Reporting & Analysis

- Enterprise Performance Reporting & Narrative Reporting (Formerly EPRCS)

- Business Intelligence (OAC)

- Enterprise Data Management (Formerly EDMCS)

Pros:

- Oracle EPM is a comprehensive suite that covers budgeting, planning, forecasting and advanced analytics, providing a breadth of well-known capabilities for EPM based on the reputation of Hyperion Solutions

- Integration with Oracle solutions (ERP, HCM, CRM, etc.) and databases, and a robust solution for master data management, data integration and data quality

- Large customer base and global network ensuring access to a pool of skilled professionals, services, partners, and domain experts

Cons:

- Lack of parity in Financial Consolidation and Close, and Planning for consolidation and planning capabilities compared to Hyperion HFM and Planning

- Fragmented, multiple solutions that require multiple complex integrations across solutions to reconcile actuals with plans and to bring in financial and operational data to support the end-to-end consolidation, close, financial & operational planning, and reporting processes

- Limited live references and few peer reviews/insights for the cloud EPM solutions

4. Wolters Kluwer CCH Tagetik

Tagetik was originally developed in 2005 to deliver trusted, comprehensive and scalable CPM solutions globally and was acquired by Wolters Kluwer in 2017. Today, CCH Tagetik is marketed as an end-to-end financial close and consolidation solution for group and entity controllers. Tagetik is comprised of multiple solutions for financial consolidation and close, account reconciliation and transaction matching, financial and management reporting, disclosure management (via a partnership with CoreFiling), and ESG & sustainability performance management – available both on-premise and in the cloud.

Tagetik positions themselves as having a unified platform for CPM/EPM – at least at first glance. The details of how the solutions work together instead make it clear that the platform still suffers from some of the same integration and solution complexities as the multiple application approaches of other vendors in the CPM/EPM market.

Pros:

- Better platform approach than other multi-solution approaches in the CPM/EPM market, such as SAP and Oracle

- Prebuilt connectors for SAP and SAP S/4HANA and a data quality engine to integrate with ERPs and other data sources, both financial and operational

- Ability to combine balance and transactional data in the platform

- Deep knowledge in Finance and solution capabilities, especially for global statutory consolidations

Cons:

- General-purpose APIs for bidirectional integration with any open system, but a below average number of support APIs and certified connectors compared to the market

- Limited to one cube per application, affecting performance, scalability and, in most implementations, requires multiple applications to support CPM/EPM processes – resulting in the same integration and solution complexities as the multiple application approach of other vendors in this article

- Limitations on data quality, assurance and drill back result in additional steps, time and manual processes to resolve data issues, with no transparency to drill back to the source

- Strong European customer base but without the same North American footprint of the other top alternative vendors

5. Workday Adaptive Planning

Workday Adaptive Insight was founded in 2003 as a planning solution with limited consolidation capabilities and acquired by Workday in 2018. It was rebranded initially as Adaptive Planning, but it is now being marketed as Adaptive Planning and Consolidation, through a combination of their field level partnership with Fluence and a simplified version of their ERP, Workday Financials.

Workday Adaptive Planning covers planning, consolidation, analytics, and reporting functions. Built on a proprietary in-memory database, the solution enables collaboration and real time updates in a spreadsheet-like browser user interface and supports integration of data from ERP and other source systems.

Pros:

- Like SAP and Oracle, Workday offers a full-stack ERP, Human Capital Management, Peakon Employee Voice, Strategic Source and Adaptive Planning for business process support and CPM/EPM

- End-to-end financial planning process support that covers budgeting, forecasting and strategic planning

- Adaptable to changes in business requirements, by design, allowing organizations to adjust their plans and forecasts as business needs change

- Intuitive and user-friendly interface, reducing the learning curve for users and facilitating easier adoption across different departments

Cons:

- Best known as a planning solution, consolidation capabilities are weak, especially for complex global consolidations, and close capabilities are limited – other than what’s built into Workday Financials. To get CPM/EPM capabilities comparable to the other top alternative vendors, Workday will either position its field-level partnership with Fluence or Adaptive Planning with a simplified version of Workday Financials ERP, which may only be logical for Workday customers

- Fragmented, multiple solutions and technologies require multiple complex integrations across solutions to reconcile actuals with plans

- While positioned as a comprehensive set of capabilities, Workday Adaptive has a limited data model for all CPM/EPM processes and has limited data integration capabilities for managing the multiple ERP and other source system data integrations needed for consolidation, close, and financial & operational planning, reporting, and analysis

Conclusion: Choose the Best SAP BPC Alternative

As organizations look for alternatives to SAP BPC, OneStream’s Intelligent Finance Platform stands out as the best alternative. Why? To start, OneStream provides a modern, unified platform for consolidations, close, financial & operational planning, reporting and analysis. The platform also finally delivers on the elusive one source of truth.

With over 1,300+ customers, many successful migrations from SAP BPC to OneStream and a mission to ensure every customer is a reference, OneStream stands as the truly unified platform for CPM/EPM.

Want to know more? Check out OneStream’s video about what comes after SAP BPC/BFC/BCS here.

Watch VideoGet Started With a Personal Demo