The consolidation process is critical in driving trusted and effective book of record reporting for an organization. Whether the organization is private or publicly held, reporting for external stakeholders must be accurate, timely and compliant with US GAAP, IFRS or other local regulations. These requirements apply to financial statement reporting, for both tax purposes and statutory reporting/filings for regulatory bodies.

In this blog post, we review the 5 best financial consolidation software solutions for 2024. We only included software that meets the following non-negotiable qualifications:

- Included in the Leaders Quadrant or close to the edge of the leader’s box – Gartner Financial Close & Consolidation 2023.

- Earned at least 4.7/5.0 stars on Gartner Peer reviews.

- Possesses its“own” dedicated financial consolidation capability.

What Is Financial Consolidation Software?

Financial consolidation software gives organizations the capability to automate and streamline the process of combining, summarizing and transforming data from multiple business units, subsidiaries or departments. This complex process ensures the completeness and accuracy of the data to comply with relevant accounting standards and regulatory authorities.

Common features across financial consolidation tool options include the following capabilities:

- Advanced foreign currency translation.

- Powerful, automated intercompany eliminations.

- Flexible organizational ownership structures.

- Audit trails.

- Drill-through analysis.

By leveraging these features and others, organizations can streamline their consolidation process, minimize errors and report with confidence.

This comparative analysis explores the features and functionalities of 5 leading financial consolidation solutions: OneStream, Oracle EPM Cloud, Wolters Kluwer CCH Tagetik, Fluence Technologies and Vena Solutions.

The Best Financial Consolidation Software

1. OneStream

OneStream is the leading solution for complex financial consolidations due to its unified platform, advanced features, real-time insights, streamlined data integration, regulatory compliance support, scalability, user-friendly interface, collaboration tools and cost-effectiveness. As organizations continue to navigate the complexities of the global business landscape, OneStream stands as a reliable partner in achieving efficient, accurate financial consolidations.

Pros:

- Capability to handle the most complex global consolidations thanks to Extensible Dimensionality, guided workflow and out-of-the-box advanced financial intelligence capabilities.

- Seamless integrations with ERP systems through a variety of data load options, ensuring data consistency and accuracy.

- Complete audit trails and drill-through/drill-down capabilities for maximum visibility into any number.

Cons:

- OneStream’s tailored implementation process may require additional configuration time to meet customers’ unique business requirements.

- Pricing may be prohibitive for smaller businesses.

OneStream may have a smaller but growing market presence compared to other alternatives – despite growing popularity and having 1,300+ customers across the globe.

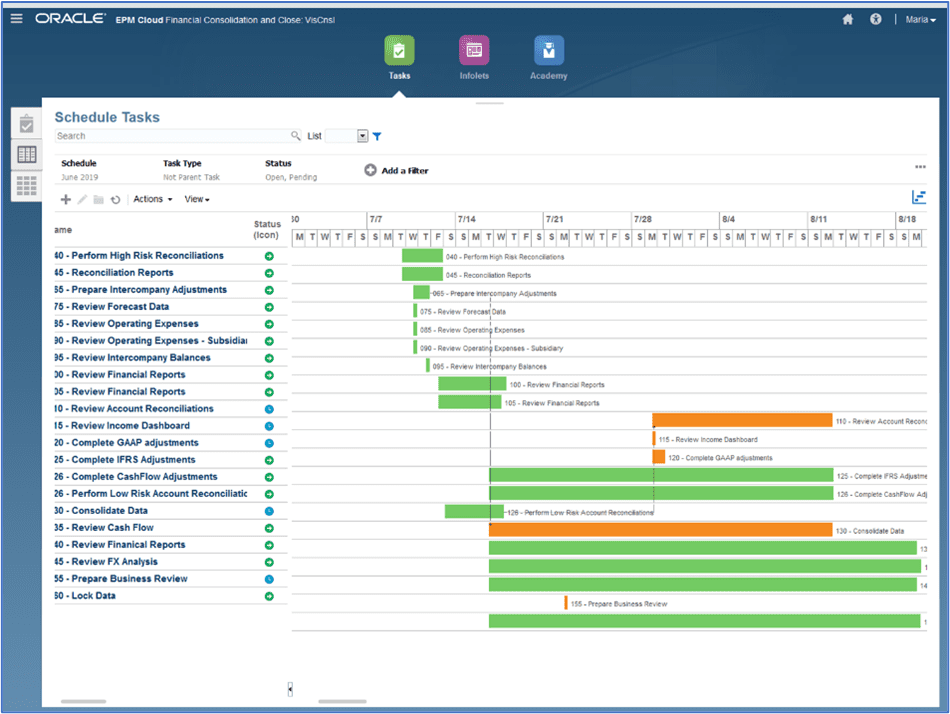

2. Oracle EPM

Oracle EPM is a suite of business applications designed for end-to-end management of enterprise-wide consolidation, close, financial planning and forecasting, and performance reporting. According to Oracle with their Financial Consolidation and Close end-to-end solution, organizations can effectively and efficiently manage the consolidation and close process. Organizations can leverage out-of-box financial consolidations with pre-built cash flow, balance sheet and income statement – accelerating the close.

Pros:

- A large customer base and global network ensure access to a pool of skilled professionals, services, partners and domain expertise.

- Integration with Oracle solutions (ERP, HCM, CRM, etc.) and databases, and a robust solution for master data management, data integration and data quality.

- Some pre-built functionality and out-of-box content may speed up implementations.

Cons:

- Lack of parity in Consolidation & Close solution for consolidation capabilities exists compared to Oracle’s legacy Hyperion HFM solution.

- Fragmented, multiple solutions require multiple complex integrations across solutions to reconcile actuals with plans and to bring in financial and operational data to support the end-to-end consolidation, close, financial and operational planning, and reporting processes.

- Limited live references and few peer reviews/insights are available for the cloud EPM solutions.

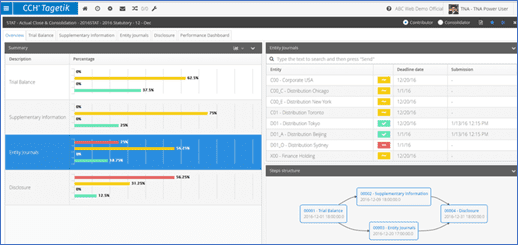

3. Wolters Kluwer CCH Tagetik

CCH Tagetik was originally developed in 2005 to deliver trusted, comprehensive and scalable CPM solutions globally and was acquired by Wolters Kluwer in 2017. As an end-to-end financial close and consolidation solution, CCH Tagetik is marketed to group and entity controllers. The software comprises multiple solutions for financial consolidation and close, account reconciliation and transaction matching, financial and management reporting, disclosure management (via a partnership with CoreFiling), and ESG and sustainability performance management. Plus, the solution is available both on-premises and via the cloud.

Pros:

- Platform approach that differs from multi-solution approaches (e.g., SAP and Oracle).

- Prebuilt connectors for some ERPs and a data integration engine to integrate with ERPs and other data sources, both financial and operational.

- Ability to combine balance and transactional data in one platform.

Cons:

- Limited to one cube/model per application, affecting performance/scalability; most implementations require creating multiple applications to support processes.

- Limitations on data quality, assurance and drill back result in additional steps, time and manual processes to resolve data issues – with no transparency to drill back to the source.

- Customer base is strongest in Europe but lacks the North American footprint of the other Top 5 vendors.

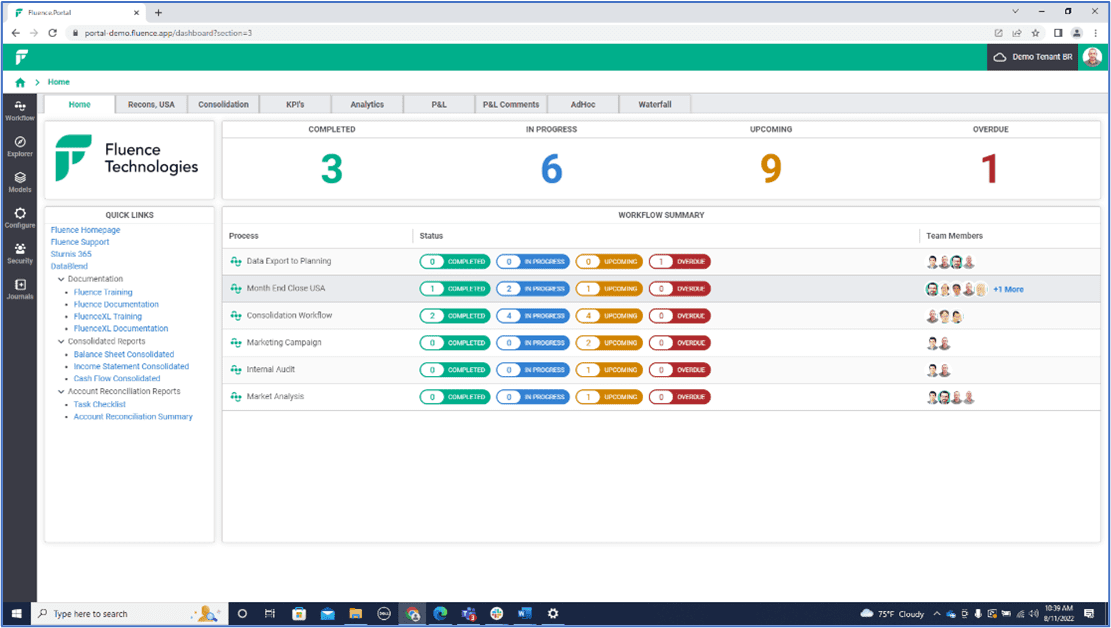

4. Fluence Technologies

Fluence Technologies is a global software company that provides cloud-based financial consolidation, close and reporting solutions marketed as helping Finance teams close faster, report with confidence and do more with less. More specifically, Fluence Technologies markets a no-code midmarket financial consolidation solution purpose-built to be easily owned and maintained by Finance.

Pros:

- Singular focus on consolidation and close.

- Heritage with legacy solutions (BPC/OutlookSoft, Cognos Controller and Longview).

- Excel front-end that provides a familiar environment for Finance and Accounting.

Cons:

- Siloed solution architecture in that the product combines home-grown, acquired and third-party solutions.

- Solution isn’t a complete CPM offering – no planning, no ESG, no tax, inconsistent AI/ML message.

- Data Integration is a user-reported weakness – limited data quality.

5. Board

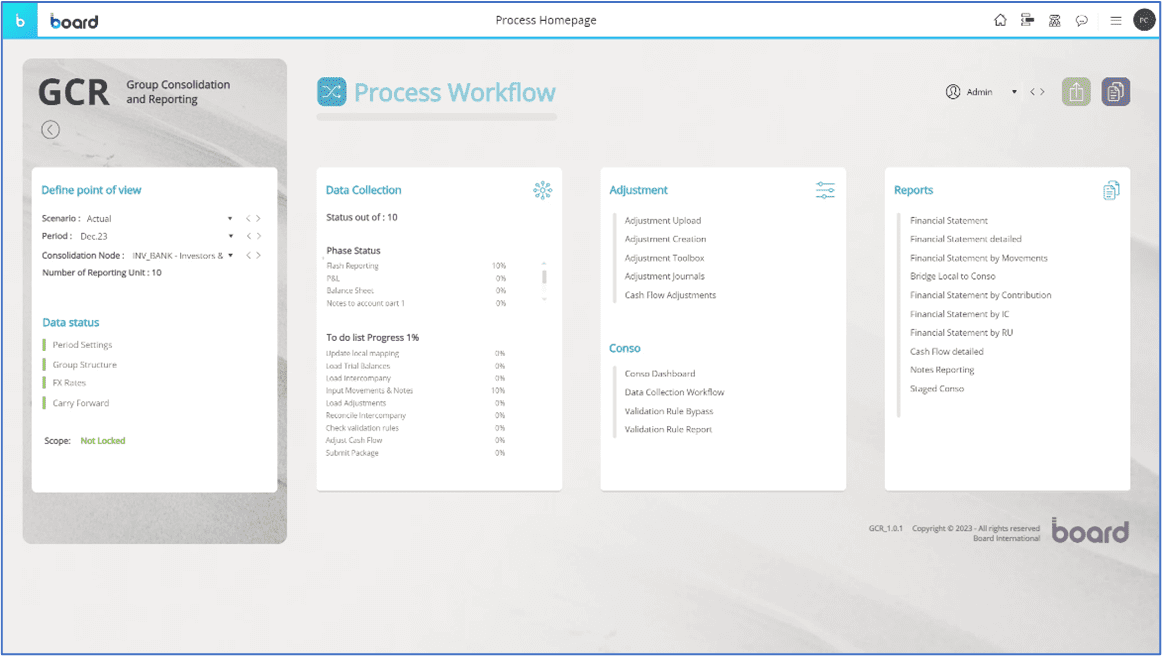

Board offers a single solution, Board Group Consolidation and Reporting (GCR). Based in Chiasso, Switzerland, where it was founded in 1994, and Boston, Massachusetts, Board markets its product as integrated business intelligence reporting and analytics with enterprise scalability. Board is a private company with customers worldwide, the highest percentage in Europe.

Pros:

- Prebuilt integrators with ERPs and over 270 APIs to multiple source systems that import GL and transactional information.

- Strong base of reference customers in EMEA region.

- Visually appealing UI with tight connection between presentation layer and the back end.

Cons:

- Board requires a tremendous amount of maintenance as everything must be built, meaning there’s little pre-built functionality.

- Limited out of the box financial intelligence means critical calculations and formulas must be designed and configured for each customer.

- Financial consolidation is a separate module – essentially a pre-built point solution consisting of dashboards and a pre-defined model.

Conclusion

Choosing the right financial consolidation platform is essential for organizations seeking to move away from unreliable, inadequate EPM applications and/or spreadsheets and to instead evolve to a modern EPM solution.

Each of the Top 5 solutions featured in this blog post offers unique features and benefits, catering to the diverse needs of organizations across industries. Ultimately, however, if you’re looking to streamline your key Finance processes and significantly increase confidence in your reporting, OneStream is the best financial consolidation software to handle all your financial reporting, no matter how complex.

Learn More

To learn more about how organizations are managing the complexity in financial consolidation, check out our Close & Consolidation eBook. And if you’re ready to take the leap from spreadsheets or legacy EPM solutions and start your Finance Transformation with OneStream, let’s chat!

You can also check out our comprehensive financial close & consolidation software resource guide.

Download the eBookGet Started With a Personal Demo