What’s the Difference Between Financial Data Aggregation and Consolidation?

On the surface, the concepts of financial consolidation vs. data aggregation might seem to mean the same thing. But financial consolidation is more than just rolling up or aggregating numbers. For instance, it involves writing data like elimination and currency translation amounts during the correct order of processing. Why? To ensure all amounts are applied at the right time as data is consolidated. Performing financial consolidation accurately and efficiently requires a purpose-built software application designed for the task.

Simple Data Aggregation

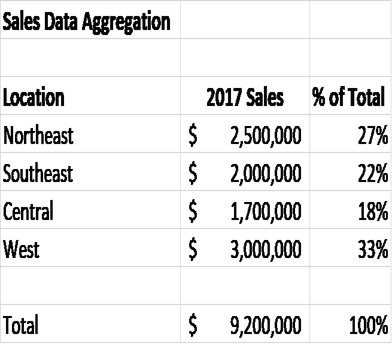

Let’s start with the concept of simple financial data aggregation. This concept involves basically any process in which information is gathered and expressed in a summary form, for purposes such as statistical analysis. In the case of aggregating sales data from different locations, the process would entail simply gathering the sales numbers for each location and adding them up to get a total. The information would then allow for analyzing how each office contributed to the total.

See example below:

Financial Consolidation

For the purposes of financial reporting results in the form of a consolidated income statement and balance sheet to stakeholders (in accordance with US GAAP, IFRS or other global reporting guidelines), consolidation is more than just adding up or aggregating data.

Financial consolidation involves specific calculations and accounting adjustments (e.g., intercompany balancing amounts) that must be written and applied at the right time as the numbers are consolidated from the subsidiary level to the parent company level. This process can include the following steps, among others:

- Doing foreign currency translation – with accounting rules applied correctly for income statement vs. balance sheet accounts

- Eliminating intercompany transactions and balances

- Adjusting journal entries

- Accounting for partial ownership, joint ventures

There are also different methods of consolidation. Plus, the methods can vary depending on the controlling stake a parent organization has in a subsidiary – ranging from full consolidation to the equity method.

Software Approaches

Accounting departments manually performed financial close for many years. But in today’s world, several types of software tools are used to support financial consolidation and reporting:

- General Ledger System – The GL module of today’s ERP systems typically has many of the required features and works well if an organization has a single ERP system. But this approach can become cumbersome. An example is when financial results must be collected and consolidated from multiple systems used by different locations or subsidiaries and GLs don’t provide the flexibility to consolidate across multiple hierarchies. The approach is also used to support what-if analysis for potential mergers or acquisitions.

- Spreadsheets – While widely used by Finance and Accounting professionals, spreadsheets weren’t designed to support a complex process with multiple users with controls and audit, such as in financial consolidation. Loading data from different systems is a manual process using spreadsheets. And with hundreds of tabs being consolidated in a workbook, the spreadsheet can become difficult to maintain and performance will degrade. Undetected errors can easily occur with the lack of adequate controls. Plus, spreadsheets don’t provide adequate audit trails regarding changes to financial results.

- Purpose-Built Financial Application – Purpose-built financial consolidation applications are becoming the preferred approach for large enterprises. Such applications are designed to integrate data from multiple sources, have specific built-in functionality to handle the complexities of financial consolidation, and typically have all the required security and audit trails. Despite having been historically deployed in on-premises data centers, these systems are now available as cloud or software as a service (SaaS) offerings.

Evaluating Packaged Consolidation Applications

Not all packaged financial consolidation applications are equal in capabilities. In fact, differences in feature sets should be carefully considered. Some are designed to support basic financial consolidations, while others are designed to support complex consolidations – with complex ownership structures, intercompany relationships, and statutory reporting and audit requirements.

Differences also exist in the underlying database engines used to handle financial consolidations. Any vendor whose product uses an on-line analytical processing (OLAP) database (e.g., Microsoft Analysis Services, Oracle Essbase, IBM Cognos TM1, SAP HANA) or similar straight aggregation engines, will face numerous challenges to address core financial consolidation requirements described earlier. To recap, those requirements include currency translation, intercompany eliminations, journal adjustments, partial ownership, consolidation status and cash flow algorithms. And these engines aren’t designed to provide an accurate audit trail for each step in the process of how the data for a specific entity is calculated, adjusted, translated and eliminated into each of its parent entities.

Only a few purpose-built financial consolidation engines are available in the CPM market. Oracle Hyperion Enterprise (now unsupported) and Hyperion Financial Management had purpose-built financial consolidation engines. OneStream is a more modern platform that has a purpose-built financial consolidation engine.

Although many vendors claim financial consolidation as a core capability, most have settled on using a straight aggregation engine instead of implementing a purpose-built financial consolidation engine. Vendors that have enjoyed some initial success with planning-only solutions are now facing market pressures, forcing them to inaccurately claim that they have true financial consolidation capabilities.

More Information

To learn more, download our Financial Consolidation and Reporting eBook.

Learn MoreGet Started With a Personal Demo