Corporate performance management (CPM) applications are designed to support specific finance processes such as planning, forecasting, financial close and consolidation, financial and management reporting and a broad range of analytics. What makes purpose-built software applications so valuable in supporting these processes is what’s known in the industry as “financial intelligence.” Why is this important? Because having built-in financial intelligence speeds the implementation process, reduces costs, and ensures the accuracy of the results produced by the application.

Spreadsheets and general purpose relational or multi-dimensional databases may appear attractive in supporting financial processes due to their implied flexibility – but they don’t have pre-built financial intelligence. Ironically, some CPM applications also don’t have pre-built financial intelligence. With these solutions the financial intelligence must be built during the implementation process. When this is the case, the implementation process will typically be longer and more expensive. And, when used in practice, an application that requires custom building of financial intelligence has a higher risk of producing inaccurate results and can be more difficult and expensive to upgrade and maintain. Read on to learn what to look for when assessing CPM applications and the level of financial intelligence that’s included in the solution.

Eight Key Elements of Financial Intelligence

Let’s look at the eight key elements of financial intelligence that should be available out of the box in a CPM software application or platform being evaluated to replace spreadsheets or outdated legacy applications.

- Account Intelligence – simply put, the solution should understand financial account types; including assets, liabilities, equity, revenue, expense, intercompany as well as statistical or non-financial accounts. Having account intelligence is important because the system needs to natively understand how to handle debit and credit activity and how to present account balances in financial statements, including the balance sheet, income statement and cash flow. This intelligence is also important when comparing actual results to budget or forecast. (e.g. actual revenue higher than budget is positive, actual expense higher than budget is negative). You would think this is table stakes in a CPM solution and it will appear to be so in most “canned” demos. Confirm that account intelligence is built-in, otherwise you will end up paying consultants to build and maintain it.

- Time Intelligence – this is the ability for the solution to automatically accumulate data over time and support various time-based calculations. This includes month-to-date (MTD), quarter-to-date (QTD), year-to-date (YTD) calculations, trailing 12-months (TTM), trailing 12 months averages and roll-forwards. Having this intelligence is important for comparative analysis of financial results such as comparing results for the current vs prior period, or YTD results for this year vs. the prior year. Time intelligence automatically updates calculations and reports when the current period is changed to streamline the reporting and analysis process

- Currency Intelligence – since data for reporting or planning purposes is often entered or collected in different currencies, the solution needs to have built-in currency translation capabilities. This should include translation rules for balance sheet vs. income statement accounts, constant currency using either actual or budgeted translation rates and cumulative translation adjustment (CTA) for each account and period.

- Intercompany Intelligence – this capability is important when consolidating data across entities that have investments in each other or sell goods or services to each other. These “intercompany” sales or investments need to cancel out as data is consolidated to ensure that sales and/or expenses aren’t overstated in the consolidated financial statements. The software should provide the capability for Intercompany account balances that don’t match to be easily identified and resolved so that the consolidated financial results can be finalized. This is required capability for financial consolidation but is also often valuable in the planning process as well.

- Cash Flow Intelligence – reporting, analyzing, and forecasting cash flow is an important requirement, especially in times of disruption and market volatility. Cash flow intelligence requires the software solution to have the ability to isolate movements in both income statement and balance sheet accounts related to cash flow. This includes visibility into how an account changed from one period to the next, isolating activity versus the currency impact on cash flow, as well as disposals or purchases of property, plant and equipment (PPE) or capital infusions.

- Consolidation Intelligence – consolidating financial results for either financial reporting or planning purposes is more than just adding up or aggregating numbers. There are specific rules and calculations that must be executed throughout the process in order to accurately produce consolidated financial results. This includes the following steps:– Calculating base-level entities

– Accurately handling currency translation

– Determining ownership and control (if applicable) for consolidation purposes

– Automated intercompany matching and elimination

– Incorporating the impact of manual eliminations, journal entries/adjustments

– Accurately consolidating entity data up a hierarchy to their parents

– Support for multiple consolidation hierarchies – e.g. management, legal, geographical, divisional.A purpose-built financial consolidation engine will perform these steps efficiently and accurately with a significant amount of automation built-in. Solutions built on standard aggregation engines will require workarounds and custom development of capabilities that are inherent in a consolidation engine. Aggregation engines will struggle in completing these steps efficiently and accurately across multiple hierarchies.

Security and Audit Trails – having the ability to control read/write/update access by users and groups is an essential control required in financial applications. Having complete audit trails for all data changes and processing steps is essential for applications that will be used to report official “book of record” financial information. Audit trails are also beneficial in understanding the evolution of data throughout the budgeting, planning or forecasting processes.

Security and Audit Trails – having the ability to control read/write/update access by users and groups is an essential control required in financial applications. Having complete audit trails for all data changes and processing steps is essential for applications that will be used to report official “book of record” financial information. Audit trails are also beneficial in understanding the evolution of data throughout the budgeting, planning or forecasting processes.- Financial Statement Reporting – a financial consolidation or planning solution is not complete if it doesn’t include the ability to produce formatted financial statements. This includes highly formatted reports such as the balance sheet, income statement, statement of changes in equity and cash flow statement documenting sources and uses of capital. These statements need to be produced consistently at both the consolidated parent company level and the subsidiary/entity level and should support the ability to seamlessly drill down into the underlying details behind every line of a financial statement.

In summary, the eight key elements highlighted above, are critical must-haves for purpose-built software applications supporting the financial close and consolidation, planning, forecasting and reporting requirements of sophisticated enterprises.

OneStream Goes Above and Beyond

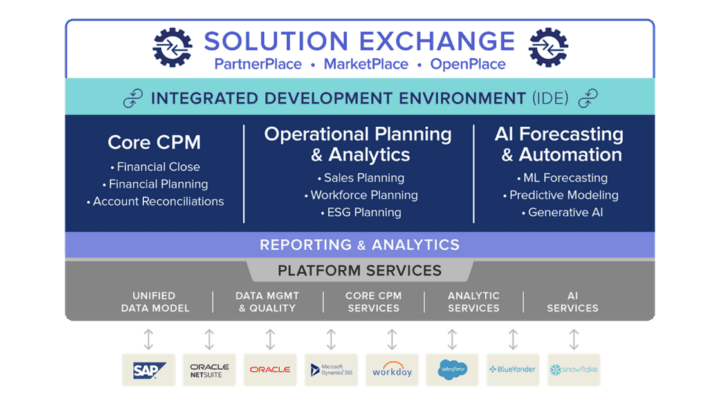

Figure 1 – OneStream’s Intelligent Finance Platform

OneStream’s unified Intelligent Finance Platform (figure 1) is an example of a purpose-built application designed to support core CPM processes such as financial close and consolidation, financial planning and forecasting, and account reconciliations as well as operational planning and analytics as well as AI-powered forecasting and automation. From the start it was designed with a high degree of financial intelligence, suited to meeting the requirements of accurately and efficiently executing these processes in a large, complex enterprise.

In addition to providing out of the box support for the key elements of financial intelligence mentioned above, the OneStream platform provides several unique advantages that other solutions don’t offer:

Extensible Dimensionality – this is the unique capability of OneStream to support corporate standards while allowing users to add the level of detail required for planning and reporting at operations levels. This capability is what allows customers to replace multiple legacy applications with a single instance of OneStream.

Integrated Financial Data Quality – with OneStream, Financial Data Quality is not a module or separate product, but part of the core platform. When it comes to financial reporting, speed and accuracy are of paramount importance. OneStream’s Financial Data Quality Management provides strict controls to deliver confidence and reliability in the quality of financial results.

Data Blending – not all data belongs in a cube, so OneStream provides the ability for customers to capture and blend detailed transactional data, relational data and multi-dimensional data in a single platform. This allows users to perform detailed driver-based planning, or comprehensive analysis and data visualization with high performance, all within a single application.

Solution Exchange – the OneStream Solution Exchange provides over 75 pre-built solutions customers can download, configure and deploy to address additional requirements without adding technical complexity to the application.

Learn More

Financial consolidation, reporting, planning, budgeting and forecasting are specific processes that require speed and accuracy to perform effectively. Any organization that attempts to use spreadsheets, relational or multi-dimensional databases, or packaged CPM applications that don’t have built-in financial intelligence to support these processes will need to custom-develop these capabilities into the platform. This adds time and cost to the implementation, as well as complexity to the upgrade process. And if these elements are not designed correctly, they could yield inaccurate results.

OneStream’s Intelligent Finance Platform includes the eight key elements of financial intelligence described in this article, as well as the additional capabilities highlighted in order to support the needs of the world’s largest and most complex enterprises. To learn more, check out our Intelligent Finance Video or contact us if you are ready to replace spreadsheets, point solutions or legacy CPM applications with an intelligent finance platform built for the future.

Get Started With a Personal Demo

Security and Audit Trails

Security and Audit Trails