How Dril-Quip Unified and Streamlined Reporting and Planning with OneStream

Reliance on spreadsheets and email for financial reporting and planning can work for some small businesses. But in larger organizations, these tools can bog down the close process, result in errors, hinder agile planning, and limit management visibility and decision-making. That’s why sophisticated enterprises are adopting unified corporate performance management (CPM) platforms. Why? They accelerate finance processes, increase control and accuracy, and drive accountability across regions and departments.

This was the focus of a recent webinar titled “How Dril-Quip Unified and Streamlined Reporting and Planning with OneStream.” Dril- Quip has extended its use of OneStream’s SmartCPMTM platform from financial consolidation and reporting, to planning, budgeting, forecasting and XF MarketPlace solutions for People, Capital, and Sales Planning. Leveraging OneStream, Dril-Quip has built an entirely new performance management framework including a driver-based, 18-month rolling forecast with increased accountability and agility across global finance and business groups.

Moderated by OneStream VP of Product Marketing John O’Rourke, the featured speakers were Trevor Ashurst, Manager of FP&A and Investor Relations at Dril-Quip, and Sunita Biswas, Consulting Manager with OneStream partner Holland Parker. Here are some of the highlights from the discussion.

Dril-Quip Background and Challenges

Dril-Quip, Inc. is one of the world’s leading manufacturers of offshore drilling and production equipment primarily used in deepwater applications.

With operations in the United States, Brazil and Singapore, Dril- Quip’s manufacturing is vertically integrated, meaning that certain products can be initially manufactured in one location and then transported to another location to be finished and/or sold. Like in other sophisticated enterprises, these intercompany transactions must be accounted for appropriately for financial consolidation and external reporting purposes. Such transactions can also make it difficult for organizations to effectively manage cost and inventory throughout the internal supply chain.

During Mr. Ashurst’s overview, he described several business challenges associated with using spreadsheets to manage complex financial consolidations and how these challenges directly impacted the ability for Dril-Quip executives to draw insights from the business and guide important decision analysis. Mr. Ashurst grouped Drill-Quip’s business challenges into the following four categories:

- Excel-Based Environment

- Manual close process

- Lack of control created inherent risk in data quality and security

- No Data Transparency

- Auditability of data was lost in spreadsheets

- No financial visibility at the regional/entity level

- Accountability

- Unable to monitor workflow progress at the regional level

- Time Consuming

- Consolidation part of the close took approximately 3 days to complete

- Inefficient processes in place for reviewing and analyzing data

Exploring the Alternatives

To address these business challenges, Dril-Quip sought to implement a new performance management platform to reduce risk, increase speed, and technically enable finance and accounting teams with better transparency into the business. The project was initially scoped over 2 phases, beginning with back-office automation in Phase 1 and focusing on the finance business partner and line-of-business teams in Phase 2:

- Phase 1: Financial consolidations, upgrades, and hardware requirements

- Phase 2: Budgeting and planning

Dril-Quip evaluated OneStream XF and Oracle HFM, requesting both vendors to present demos to Financial Reporting, International Accounting, and Senior Management to ensure the application would address SEC filings, statutory requirements and growth initiatives. Additionally, Dril-Quip requested each vendor build a 5-year total cost of ownership analysis inclusive of consolidations, forecasting, account reconciliations, additional users, hardware, and upgrades as part of the final selection criteria.

Drilling Down on ROI

Ultimately, Dril-Quip chose OneStream XF, which aimed to bring a favorable return on investment while meeting the business requirements of creating a unified and streamlined solution and better service delivery. OneStream was initially deployed as an on-premise solution that could run on existing servers, whereas Oracle required specific hardware that would need to be purchased. Later, Dril-Quip leveraged the XF Cloud support team at OneStream to seamlessly move to the Microsoft Azure cloud within hours.

Multiple Solutions, One Platform

Dril-Quip implemented OneStream XF to deliver multiple solutions to meet all its financial reporting and planning requirements in one application. This included the following requirements:

- Corporate financial consolidation and reporting

- Global rolling 18-month forecast

- Sales Planning to leverage data from Oracle CRM and an internal backlog report

- People Planning to manage headcount and salary planning

- Capital Planning to manage fixed assets and depreciation planning

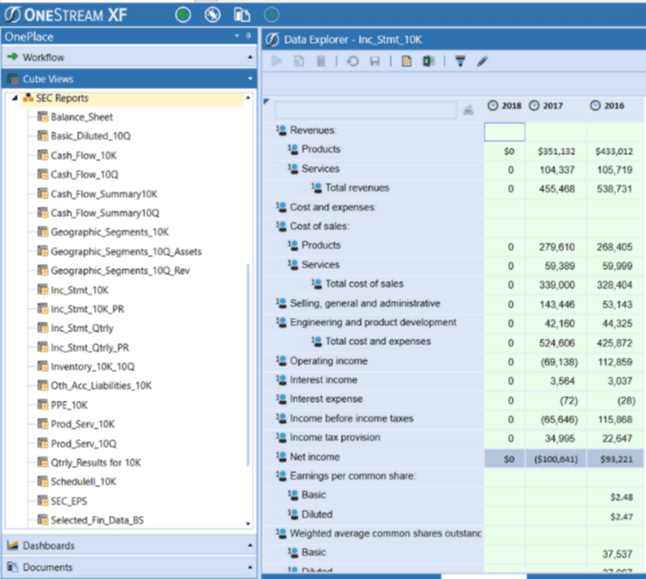

Replace Excel, Automate Intercompany, Streamline Financial Reporting

Ms. Biswas then presented an in-depth overview of Dril-Quip’s journey from the use of spreadsheets and manual business processes to OneStream’s function-forward, modern platform.

manual business processes to OneStream’s function-forward, modern platform.

Dril-Quip replaced several spreadsheets and homegrown solutions with the unified OneStream XF platform. This delivered a simplified process by providing global regions the ability to load their own trial balances directly from the general ledger, providing timely and accurate reporting.

With pre-built functionality for automatic intercompany eliminations, OneStream makes it easier for business units to identify and quickly resolve any out of balance conditions with their intercompany accounts. OneStream also generates Dril-Quip’s 10-K and 10-Q using custom dimensions within the application.

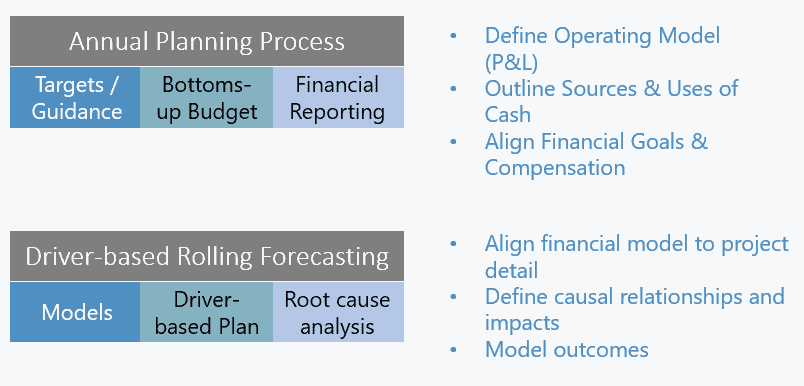

Financial and Operational Budgeting and Forecasting

To align financial results with operational plans, Dril-Quip developed an 18-month rolling forecast process to capture key drivers of the business from each of the world-wide sales, operations and HR leaders – creating a true integrated planning environment.

Extend the Value Beyond Finance

Dril Quip leveraged OneStream’s XF MarketPlace to expand beyond finance, downloading purpose-built business solutions to manage critical forecast inputs and drive accountability within the lines of business. Dril-Quip’s use of the XF MarketPlace Solutions includes the following:

- Sales Planning: With Sales Planning, global regions analyze CRM and backlog data down to the customer level and incorporate the new revenue recognition guidelines into sales plans.

- People Planning: People Planning provides an easy-to-use tool to plan and manage headcount by entity and department.

- Capital Planning: Capital Planning eliminates inconsistencies in reporting and provides a consistent way for global regions to manage their fixed assets, including the ability to set global useful life drivers to ensure depreciation is calculated in accordance with company policy.

Drill Across, Drill Down, Drill Through

With seamless integration between finance, sales, HR and operations, Dril-Quip leverages OneStream’s powerful, extensible platform to enable the business to plan for its diverse needs without compromise. Every quarter, each departmental manager enters various global drivers to plan for revenue, salary, depreciation and expenses.

For Mr. Ashurst and the executive team, this provides the agility to drill-through from financial statements back to key drivers of the business, to capture insights and to prioritize where to take focused action.

External Reporting vs. Management Reporting vs. Statutory Reporting – No Problem

In global enterprises, international or diverse business units are often “forced” to adhere to corporate account structures for reporting for consistency. It also results in a compromise in local reporting and planning, or worse, the creation of a parallel administration process that can drain valuable resource time. Ms. Biswas described how OneStream’s unique Extensible Dimensionality® was able to support all the corporate reporting requirements as well as the unique local statutory reporting structure of Dril-Quip’s Brazilian business in the same application.

With OneStream’s Extensible Dimensionality®, Dril-Quip builds various reporting structures for external, management, statutory reporting and planning scenarios like budget and forecast – with full financial consolidation capabilities. With Extensible Dimensionality®, corporate and local teams analyze the numbers based on operationally relevant dimensions and levels of detail, easily filtering by reporting structures with full drill- through ability. For both management and business units, OneStream enables the organization to leverage one platform to deliver financial and business insights from virtually any perspective from the same data without compromise.

Benefits Today with More to Come

Moving away from spreadsheets to OneStream XF reduces risk, increases transparency and provides business leaders with a modern platform for continued growth for finance and beyond. Financial close, budgeting and planning, and external/internal reporting are now completed seamlessly, enabling Dril-Quip to spend less time managing spreadsheets and more time getting back to business. But that’s not all. Here are some additional benefits from the move to OneStream:

- Dril Quip can now seamlessly report actual, budget and an 18-month, rolling forecast from one application

- Key stakeholders can now spend time analyzing the data versus questioning the accuracy, allowing them to make better-informed business decisions

- Transparency and ownership of the data were key to Dril-Quip’s success

- The Consolidations team reduced the close cycle by 3 days – reporting now takes minutes to generate versus a day to collect, prepare and distribute

- Inventory recapture analysis is now completed in minutes vs. days

- The Financial Planning and Analysis group saves 60 days annually

Learn More

For more on Dril- Quip’s story, watch and listen to the replay of the webinar here and/or contact your local OneStream account executive to learn more about OneStream and how we can help you reduce reliance on spreadsheets and legacy CPM applications.

Get Started With a Personal Demo