While FP&A teams often serve as “the guardian” for organization-wide financial plans, many Finance teams struggle to transform key processes like budgeting, planning & forecasting. Why is that?

One key reason is that FP&A teams have more coming at them than ever before. They, of course, have core responsibilities like budgeting, management reporting and strategic planning. Those are the table-stakes. Beyond the basics, though, the FP&A playbook is wide open.

Consider some of the popular initiatives FP&A teams are adopting to improve the planning process:

- Moving beyond the annual operating plan to rolling forecasts

- Improving management reporting to create focus on operational metrics

- Reducing reliance on spreadsheets or legacy corporate performance management (CPM) software to improve agility

- Expanding budget ownership beyond Finance to functional groups like Sales, Operations, Marketing, HR, etc.

- Determining how to introduce new technologies (e.g., predictive analytics) into the planning processes

With so many options available, many FP&A teams are asking the same question – where do we begin?

Start by creating a roadmap for your FP&A team. What is your FP&A team setting out to achieve? Why are you doing it? Think about how FP&A should interact with the organization to help increase organizational value. How often should that dialogue take place?

The answers to questions like these, and others, were the focus of our recent webinar titled “The FP&A Roadmap – How to Advance Your Planning and Forecasting.” The webinar featured Craig Schiff, CEO and Founder of BPM Partners, who shared his insights from the BPM Partners 2019 BPM Pulse Survey.

My colleague Roy Googin and I joined Mr. Schiff to provide attendees with an overview of OneStream’s roadmap for advanced analytics and to highlight our predictive analytics solution. Here’s a quick recap of the discussion.

The FP&A Roadmap

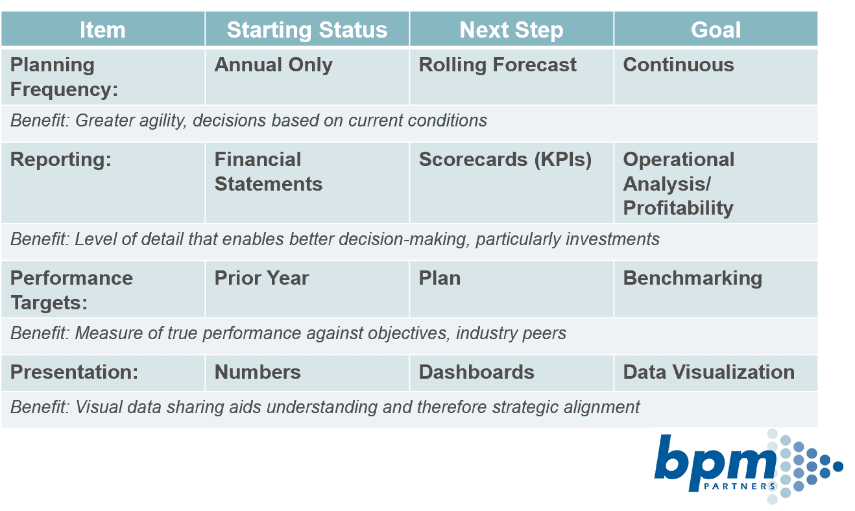

Mr. Schiff kicked off the webinar with an overview of the topic-de-jour, the FP&A Roadmap (see Figure 1).

Figure 1: BPM Partners’ FP&A Roadmap

While there’s no shortage of important initiatives like modernizing CPM technology or leveraging predictive analytics, the roadmap doesn’t prescribe how to get started. Why not? Well, every organization has unique needs, and those needs also differ at varying stages of the finance transformation. Rather, the FP&A Roadmap focuses on specific goals FP&A teams are to move forward while providing practical “next steps” to accomplish these goals. So how do you know if your FP&A team is on the right path?

One way is to gain perspective from other FP&A teams. Check out analyst surveys from BPM Partners and others, and learn how finance leaders just like you are taking steps to transform their organizations.

BPM Survey Results

Mr. Schiff then dove into the FP&A Roadmap and shared insights from the BPM Partners 2019 BPM Pulse Survey. Here are some of the key findings on each roadmap item:

- Planning Frequency – 35% of respondents are forecasting monthly, 21% are forecasting quarterly and 7% are only completing an annual operational plan (AOP).

- Reporting – 92% of respondents suggested management reporting as most important for a CPM solution to address, while 66% of finance leaders noted operational reporting and ad-hoc reporting as most important. Additionally, respondents noted that the importance of granular profitability analysis, such as product- or customer-level insights, is increasing.

- Forecasting Methodology – 38% of respondents noted their primary method to submit forecasts is direct entry, while 33% are leveraging business drivers.

- Technology – 84% of respondents are most interested in leveraging CPM technology for budgeting, planning & forecasting, and 70% suggested financial reporting as the CPM process they are most interested in. And finally, out of a score of 1-5 (5 being most important), respondents rated ease-of-use and performance and scalability as the most important aspects of their ideal planning solution.

What’s Next

Mr. Schiff concluded his presentation with a brief discussion about the advanced capabilities FP&A teams are seeking as they work through their roadmaps And even though the adoption of predictive analytics and machine learning in finance is still low, it’s just a matter of time before these technologies are mainstream. How will they reach the masses? As Mr. Schiff described, FP&A teams are looking for CPM vendors to create an easy experience so that teams can focus on creating business value rather than worrying about software.

OneStream’s Advanced Analytics Strategy

With feedback from trusted advisors like Mr. Schiff and our customers across the globe, OneStream’s roadmap is purpose-built to unify advanced analytics across all aspects of the budgeting, planning and forecasting process. How? By enabling FP&A with the unque ability to first capture data from across the entire organization and then analyze and visualize that data to develop predictive forecasts to help improve performance.

To illustrate, I shared information about a few of OneStream’s recent and upcoming solutions for advanced analytics, which are noted below:

Analytic Blend (Fall-2019)

- Dashboards & Visualizations

- Operational Analysis

Predictive Analytics 123 (Dec-2019)

- XF MarketPlace Solution

- Automatically Generates Predictive Forecasts

Machine Learning Solution (FY2020)

- Expand on Predictive Analytics 123 Solution

Analytic Blend

Analytic Blend (see Figure 2) helps FP&A and line-of-business teams blend operational and transactional data from all aspects of the organization. By unifying operational data with governed financial data in a single analytical model, finance teams are turning fast-moving (i.e., daily transactions or weekly data) into action – before month end. Why’s this unique? Well, finance leaders no longer need to wait around to capture what is often latent data from their data warehouses, create fragmented reporting silos or worry about mapping operational data to interpret the data. Analytic Blend keeps the focus on analysis and taking action. And finance teams no longer need to wait 30 days (e.g., month-end) to do it.

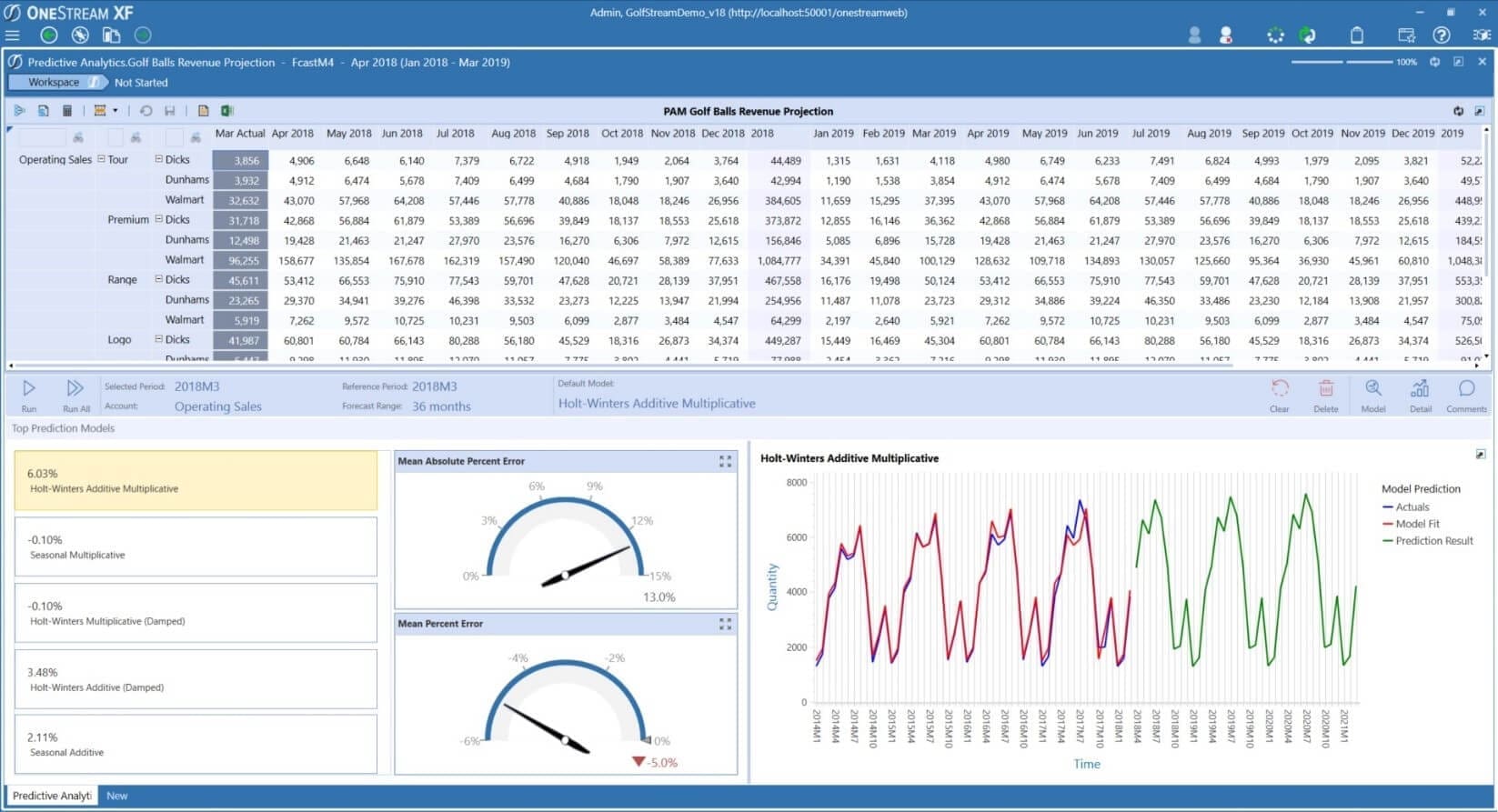

Built-In Predictive Analytics

Next up was a brief overview of OneStream’s Predictive Analytics 123 solution, which is downloadable from the XF MarketPlace. Predictive Analytics 123 (see Figure 3) automatically cycles through multiple predictive algorithms to determine the most accurate forecast type. Results are then graphically displayed and deployed across all aspects of the budgeting, planning & forecasting processes.

Figure 3: OneStream’s Predictive Analytics 123 Solution

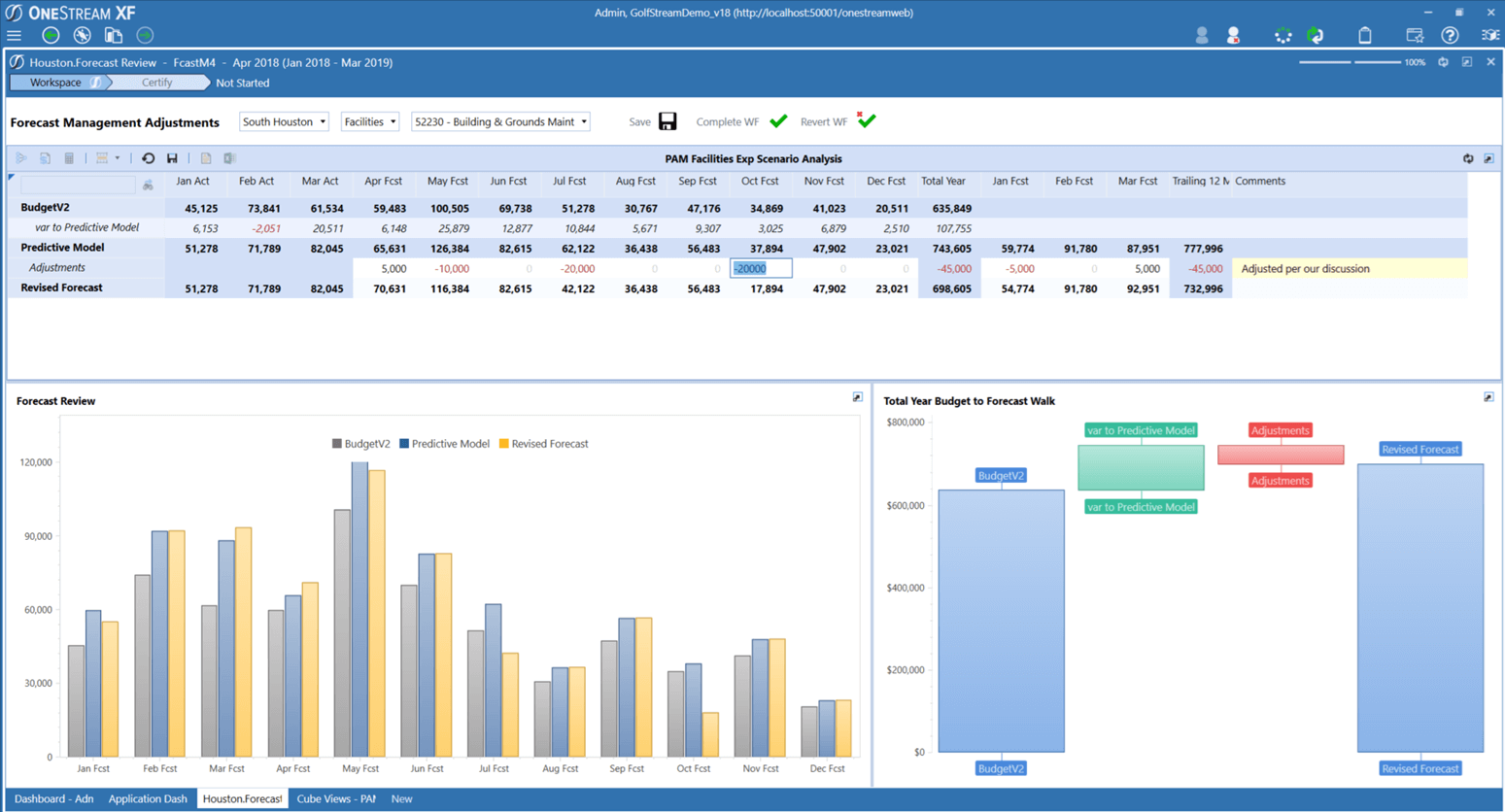

Practical Use-Cases

My colleague Roy Googin, Sr., Director of Solution Consulting with OneStream, then took over to demonstrate some practical use-cases for predictive analytics. He focused on analytics designed to help increase collaboration with various business partner groups. Here are a few use-cases Roy shared:

- Assist with the target-setting process to support strategic planning and/or AOPs

- Create baseline predictive forecast scenarios for comparison against bottoms-up, internal forecasting from divisional finance or operational business partners

- Automatically seed new forecasts with predictive models for AOP and rolling forecasts

- Adjust baseline predictive forecasts (see Figure 4) with known business changes, such as those with new customers, plant shutdowns, new acquisitions, etc.

As Mr. Googin explained, the goal of OneStream’s predictive analytics solution is to “empower users with insights as part of the ongoing planning process without having to worry about the technology or data science.”

Figure 4: OneStream’s Predictive Analytics Solution

Conclusion

Mr. Googin’s insights are spot on. And in many ways, Mr. Googin’s message represents so much about OneStream’s mission of 100% customer success. From the start, OneStream has focused on enabling finance leaders to leverage technology, not build non-value processes around our technology. Why? We want to help finance leaders create business value for their organizations. That’s our “why.”

Learn More

To learn more about OneStream’s roadmap for advanced analytics or how to advance your planning and forecasting processes, click here to watch and listen to the replay of the webinar.

Get Started With a Personal Demo