Despite improved U.S. economic conditions, state and local agencies are continuing to grapple with uncertainty. Want proof? Consider the impact the lasting effect high debt burdens and pension shortfalls are having during the budgeting process. And if that’s not enough, fluctuations in tax policies aren’t helping either, as the resulting impact to income receipts make cash flow planning murky at best.

The war for talent is also a challenge for state and local agencies, as qualified personnel resources are difficult to find. And at a time when audit oversight and operational regulations are adding additional scrutiny to the budget formulation process – top talent is also difficult to retain.

Taken together, it should come as no surprise that finance leaders within the Administration, Budget and Comptroller offices often struggle to focus on improving decision support and driving process improvements. Why’s that? Because they (finance leaders) are often left spending time manually collecting data and reconciling reports from fragmented spreadsheets and legacy tools just to get their day-to-day jobs done. Consider the sheer time and effort required to complete each step of the budgeting process, which are noted below:

- Create and disseminate Budget Guidelines and Data Entry Templates/Spreadsheets

- Consolidate Department/Agency level input into a “Total Organization” view

- Coordinate changes to entry-level-data as required by oversight directives (i.e. Historical Reference, Target Setting, Legislative Guidance, etc.)

- Manage “What If” exercises in preparation for incorporating executive adjustments (i.e., Committee Board, City Council, Mayor, Governor, etc.)

- Publish adopted plans in narrative reports for constituent consumption

- Forecast expenditure spend and execute funds transfer activities as required throughout operating period(s)

Technology as a Change Agent

More than ever, government agencies are turning to purpose-built software (with an increasing preference for cloud or SaaS models) to automate various aspects of the budgeting process such as personnel, grants, and capital expenditures planning. Designed to automate multiple processes, corporate performance management (CPM) applications move finance transformation forward by adding agility to the budgeting process and streamlining the financial close and reporting processes.

State and Local Agencies Turn to OneStream

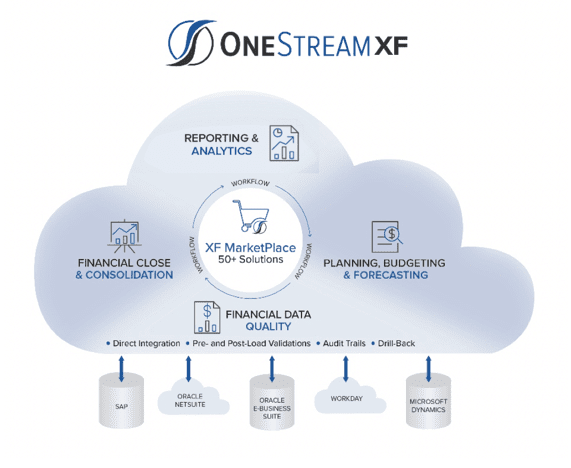

Leading Government agencies and organizations are turning to OneStream’s modern, unified platform to help address many of the challenges they face. OneStream (see Figure 1) helps state and local finance teams replace spreadsheets and fragmented legacy CPM products with a unified solution that can be deployed on-premise or in the cloud.

OneStream’s XF MarketPlace solutions allow organizations to extend their investment with more than 50 add-on solutions – such as Predictive Analytics – that can be quickly downloaded, configured, and deployed to address additional process requirements.

Figure 1 – OneStream’s SmartCPM™ platform

Here are some of the key capabilities of the OneStream XF platform for state and local agencies:

- Budget Formulation Process – Evolve the budgeting processes from manual spreadsheets to dynamic, zero-based budgets that can be updated in real-time based on changing business drivers. Dynamic modeling capabilities allow departments and/or shared services financial analysts to run what-if funding scenarios on spend management and investment evaluations with People Planning and Capital Planning.

- Financial Close and Consolidation – Reduce the time spent collecting data and allocate more towards analyzing results and providing narrative (i.e. within the Comprehensive Annual Financial Report (CAFR)). With integrated, readily auditable financial data quality, OneStream ensures accuracy and confidence in financial and operational reporting. XF MarketPlace solutions such as Account Reconciliations address additional needs in a unified approach.

- Reporting and Analysis – Financial and Operating results can be packaged and delivered rapidly through standard reports, report books, or an Excel®-based interface with the ability to drill-down and drill-through to transactional details for rapid answers.

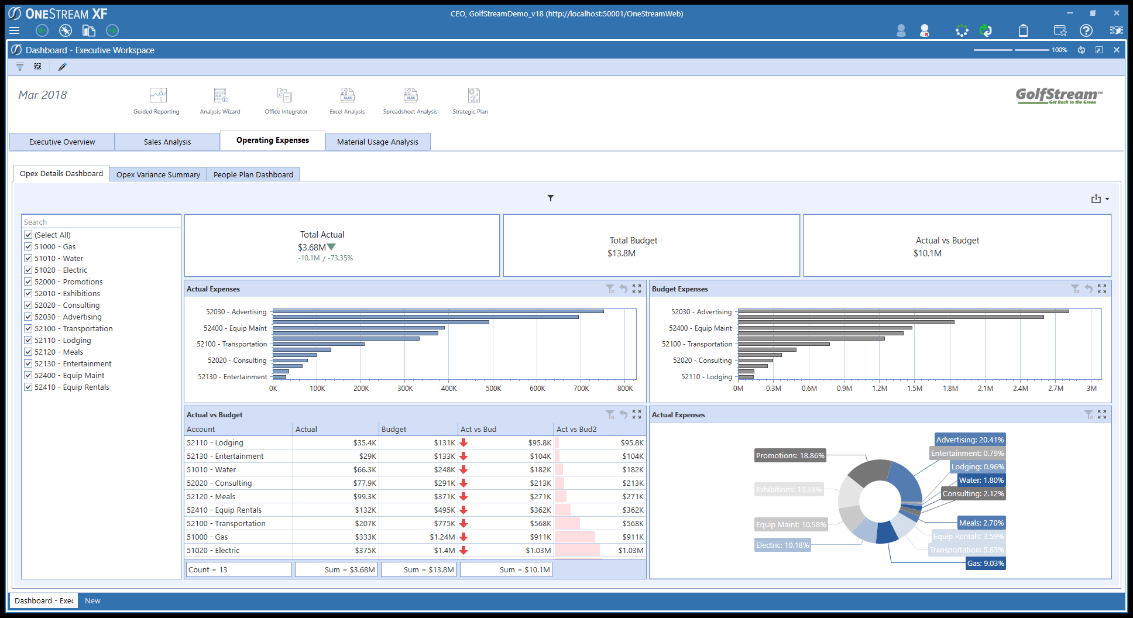

- Built-In Analytics– Detailed analytics and interactive visualizations support intuitive data review and results presentation. Graphs and charts present how the organization is performing at any given moment along with transparency into source transactions. Interactive dashboards provide insight into results by detailed slices of an organization – such as revenue/spend results by Department/Agency, Project, Program, Fund, etc.

Key Benefits

For finance teams, reducing reliance on spreadsheets and legacy software for budgeting and the financial close processes has material benefits. By automating and streamlining key processes, budget officers and accounting teams can begin to shift their time from task-oriented work like moving and reconciling data to higher value work – which increases organizational value and job satisfaction in parallel. Here are just a few other ways OneStream is helping state and local governments modernize their budgeting and financial close processes:

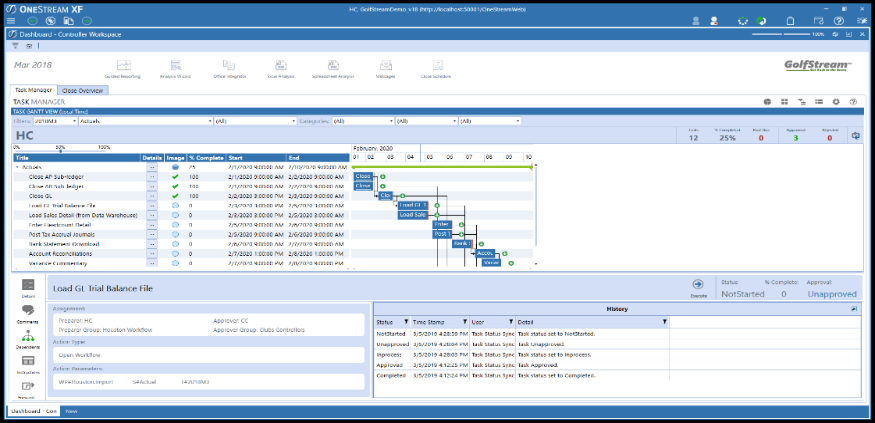

- Outline tasks via workflow that identifies responsible users, due dates, and approval chains for pre-and-post financial close and budgeting processes (see Figure 2)

- Leverage validation rules for Financial Data Quality on trial balances and reporting across statements

- Map chart of accounts members from multiple G/L systems to Report Line Items

- Share and collaborate across the organization on creating documents such as Budget Books and CAFRs

- Blend content from Microsoft Word®, PowerPoint® and Excel® to deliver visually stunning publications

- Create multi-step allocations of revenue and/or expense items for people, projects, and/or assets

- Decrease cycle times required to complete sources and uses of funds variance analysis (see Figure 3)

Bringing It All Together

No matter how big or small, modernizing corporate performance management processes like budgeting and the financial close are critical to moving finance transformation forward. For Finance leaders at state and local agencies, there’s now a clear alternative to using spreadsheets and legacy software for organizational finance processes. And unlike cloud-based point solutions, OneStream offers a full range of solutions across the Administration, Budget and Comptroller offices – providing finance teams with a foundation to meet the needs of today and grow to serve the needs of tomorrow.

Learn More

To learn more about how OneStream is helping modernize the budgeting process for state and local agencies, download our solution brief here.

Get Started With a Personal Demo