The digital transformation of finance has been underway for many years. The ability to automate manual tasks and processes using digital technologies has helped finance shift its focus from back-office processing and reporting of historic results – to forward looking forecasting and analysis of the business.

And while most organizations are using analytics in some way, according to the 2020 FSN Future of Analytics in Finance report, only 14% of finance organizations are successfully harnessing the large volumes of data being generated by transactional systems to create valuable business insights. Finance teams that have been successful in harnessing these troves of data are able to ask better questions, forecast more accurately, model scenarios and discover actionable insights that drive improved decision-making.

Read on to learn more about the findings in FSN’s report and the implications for finance organizations.

The Majority of Analytics Are Missing the Mark

Based on responses from 441 senior finance executives around the globe, the FSN report found that 86% of analytic effort is missing the mark. Why is that? The main reason is that most organizations are not extracting the true value and insights from their data. Consider a few of the findings from the report, which are noted below:

- 22% of the organizations survey revealed they do nothing more than produce cyclical reports required to operate the business.

- 34% of organizations perform ad hoc analysis only reactively, when the need arises to support strategic or tactical decisions.

- 30% of organizations report siloed/departmental use of data visualizations.

- The remaining 14% are the organizations that have repeatable analytic processes that are leveraged across the enterprise to create actionable insights and competitive advantage.

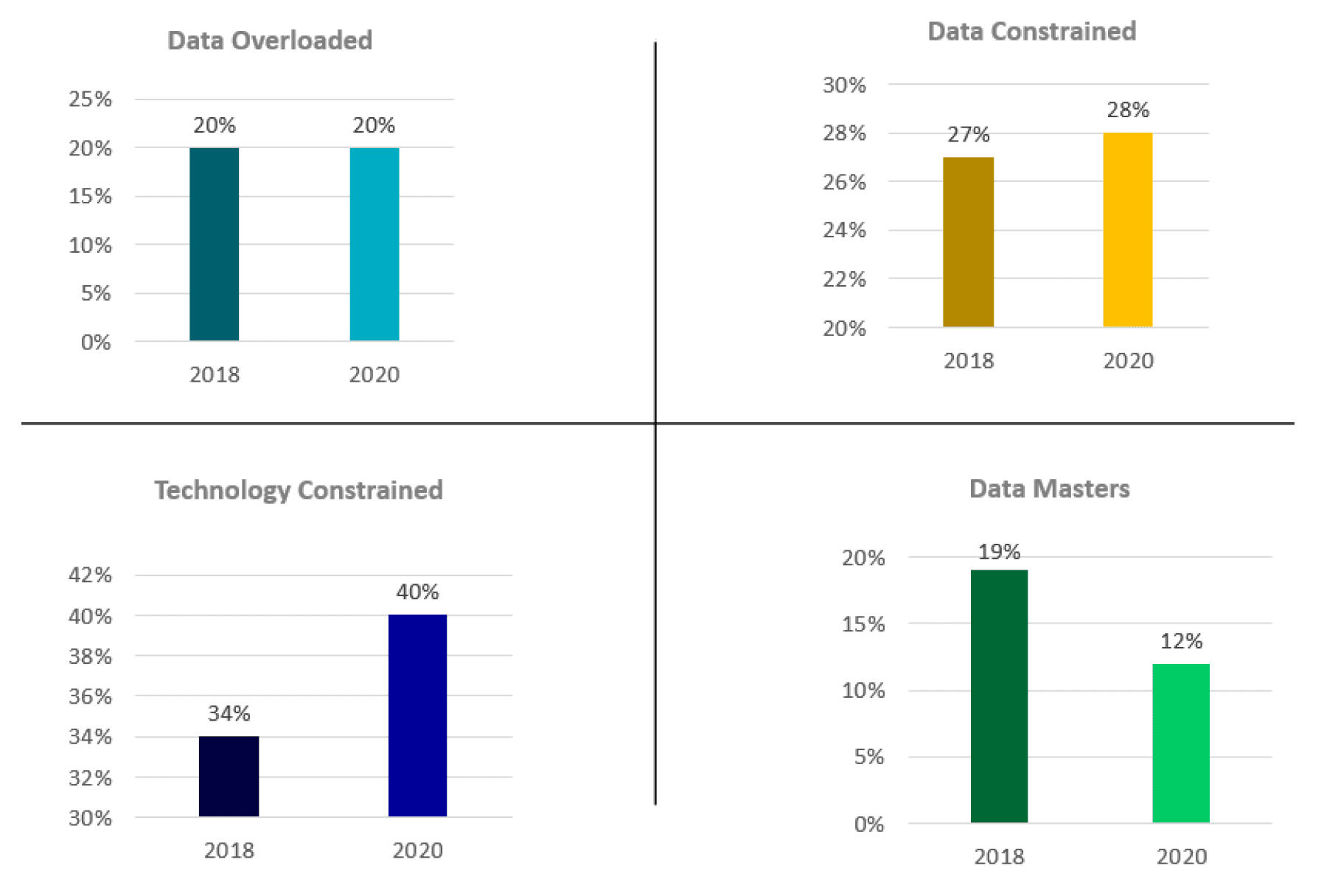

Figure 1 – FSN Survey Finds that 40% of Organizations are Technology Constrained

What’s the problem? The FSN survey found that it’s data that is holding most organizations back (see figure 1) Organizations are either drowning in too much data, constrained in accessing their data, or hindered by the technology they are using to analyze the data. In fact, the survey found that only 12% of organizations consider themselves “data masters” who actively manage their data as a corporate asset and have the right tools and resources needed to create actionable insights and competitive advantage.

Operational Data Is Often Ignored

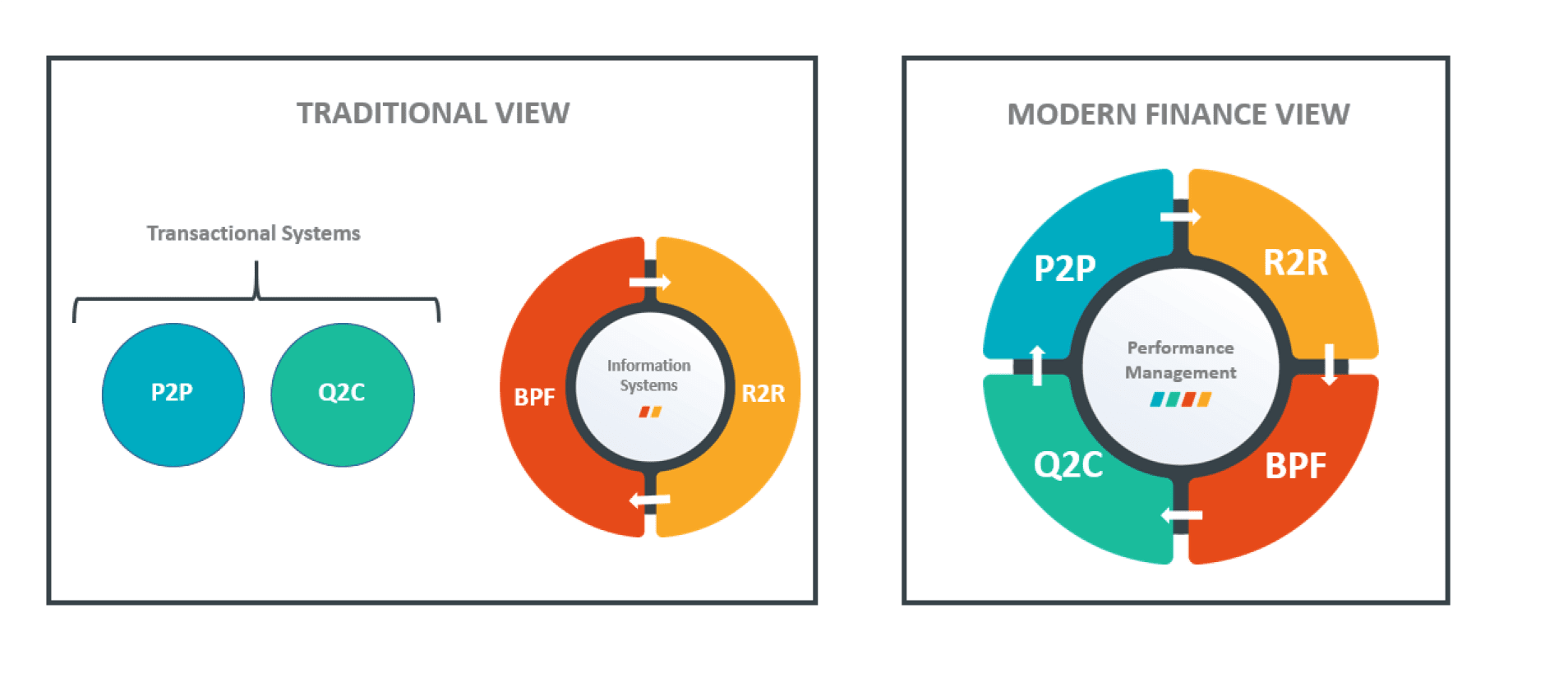

While many organizations have focused on improving their analytic processes, most of them are missing a valuable source of insights. With a lot of focus being placed on the Record to Report (R2R) process for producing financial results and the Budgeting, Planning and Forecasting (BPF) process – data from the Purchase to Pay (P2P) and Quote to Cash (Q2C) processes are being viewed as transactional and mostly ignored. Leveraged correctly, these processes can provide valuable telemetry and signals regarding customer behavior and supplier performance that can reveal key opportunities or risks to the business. In order to have a complete picture of the business, data from these and other systems and processes should be integrated and aligned with financial data to create actionable insights and support decisions that can create competitive advantage (see figure 2).

Figure 2 – Performance Management Should Encompass Operational Systems

Figure 2 – Performance Management Should Encompass Operational SystemsInformation Systems Strategy is Often Forgotten

The explosion of new technologies available in the market has many finance organizations struggling to keep pace. This includes cloud-based ERP and corporate performance management (CPM) solutions, advanced analytics, robotic process automation (RPA), predictive analytics, artificial intelligence (AI), machine learning (ML) and more. While these technologies might be useful, to succeed organizations need a holistic information systems strategy. Yet most are far from achieving this.

The FSN survey found that more than half of the respondents are not able to regularly add new sources of data to enrich business understanding, and less than half can make widespread use of non-financial data. Yet when asked about the most important features for analytical tools, respondents prioritized support for AI and ML, data visualization, KPI scorecard and dashboards. But at the bottom of the list are essential building blocks for an effective analytic system – such as easy connectivity to multiple data sources.

Seeing the Bigger Picture

The findings and results of the survey are consistent with what we are seeing in the market. Many mid-sized to large enterprises struggle to achieve efficiency and agility in their Record to Report (R2R) and Planning, Budgeting and Forecasting (BPF) processes. This is often due to reliance on spreadsheets and manual processes, or fragmented legacy CPM applications that the company has outgrown or that have become too cumbersome to manage.

Forward-thinking organizations are improving their analytical insights by unifying their formerly fragmented R2R and BPF processes to create a single version of the truth for actual financial results, budgets, and forecasts. Some have gone further and are integrating operational data from CRM, HCM, ERP and other sources with their financial data in order to gain more actionable insights into their business. This often starts with creating periodic views into revenue and profitability by customers, products, locations, channels and other dimensions of their business.

Figure 3 – Turn Signals and Trends in Data into Actionable Insights

Leading organizations are taking the next step, integrating transactional data from Quote to Cash (Q2C) and Procure to Pay (P2P) processes and systems into their analytic platform on a more frequent basis, such as weekly or daily. Accessing this type of telemetry from operational systems, and aligning it with financial data, provides these organizations with “right-time” views into key trends and signals that inform decision-making that can impact future results (see figure 3).

Supporting efficient and unified reporting and planning processes, that can be extended with operational data, requires the right analytical infrastructure as well as the right talent. In today’s volatile fast changing global economy, having information systems that provide insightful and actionable analytics are no longer an option but are critical to surviving and thriving over the long-term.

To learn more, download the 2020 FSN Future of Analytics in Finance report.

Get Started With a Personal Demo