If the COVID-19 crisis teaches us anything, it proves that the annual operating plan (AOP) is a relic of the past. Want proof? According to the Association of Financial Professionals (AFP),[1] 85% of FP&A teams are now expecting to miss their revenue and earnings targets. Why does that matter?

Well, AOPs comprise tens and sometimes hundreds of business drivers designed to help guide decision-making. And now they’re all wrong. This is nothing new for Finance leaders, of course. Even without a viral pandemic, AOPs are often wrong within seconds of the final submission. What does that tell us? Here’s my take: AOPs do little to help guide decision-making in a fast-paced environment. They’re basically just tools to anchor performance targets.

That’s why Finance teams are adopting a combination of scenario analysis and rolling forecasts during these unprecedented times. Unlike the AOP, rolling forecasts and scenario analysis help Finance leaders actually manage financial goals AND help guide decision-making.

They are, after all, designed for rapid-response finance—keeping Finance teams leading at speed and staying agile. Let’s dive into how.

Scenario Analysis Helps Finance Lead at Speed

When managing through uncertainty, Finance teams almost always look to scenario analysis as their “go-to” choice. Here are some of the key reasons scenario analysis is so popular:

- Facilitates Speed & Agility: Scenario analysis enables Finance teams to quickly create various “what-if” scenarios without requiring a full bottom-up forecast. Scenario analysis is NOT the same as a full forecast submission, so it doesn’t require input from all the typical stakeholders from across the organization.

- Focuses on Business Drivers: Effective scenario analysis focuses on business drivers that span across the organization or key lines of business. Best practice is to focus on “big-ticket” business drivers that influence revenue and costs, such as product volumes or pricing. For example, if your organization is tied to construction activity, external drivers such as housing starts or permit activity are likely good indicators of demand.

- “Flexes” Across Financial Statements: While scenario analyses focus on changes to key business drivers, effective scenario analyses “flex” each scenario to dynamically calculate the related impact across the P&L, balance sheet and cash flow statements. This approach gives Finance leaders visibility into the impact on COGS, gross margin %, EBITDA, EPS and cash flow, which are critical KPIs to understand when navigating through uncertainty.

- “Surrounds” the Numbers with Realistic Scenarios: Creating too many scenarios does little to enable sound decision-making. By avoiding that, scenario analysis creates a limited, but realistic number of scenarios you can monitor and align to key decisions. The analysis provides a clear and actionable plan, but also one that you can easily pivot from if needed. Not to mention, scenario analysis also gives CFOs the ability to “surround” the numbers. Why’s that important? Because during crisis situations, CFO’s are often asked to provide risk-adjusted guidance on new revenue or profit expectations to inform future forecasts for investors and stakeholders.

Stay Agile with Rolling Forecasts

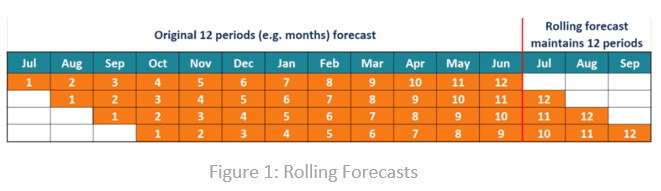

Rolling forecasts (see Figure 1) allow management to continuously plan and reallocate resources based on the latest results. And while only 14% of organizations use a rolling forecast instead of an AOP, according to The Dresner Advisory 2019 Wisdom of Crowds Survey, I expect Finance teams to rethink that approach amidst the COVID-19 crisis. Here are a few additional statistics from the same Dresner Advisory report:

- 62% of organizations are using a rolling forecast

- 35% complete rolling forecast monthly

- 21% complete a rolling forecast quarterly

Rolling forecasts also push the organization to think differently since the forecasts can extend beyond the current calendar or fiscal year. And they do so without losing the flexibility to focus on the short-term tactics required to manage through uncertainty.

OneStream Rapid-Response Solutions

OneStream Software helps Finance leaders drive performance by enabling planning, financial close & consolidation, reporting & analysis to become a seamless experience. Why’s that unique? Well, by unifying key processes, Finance leaders can eliminate the complexity of stitching together spreadsheets or fragmented systems and processes and instead focus on moving the organization forward.

The OneStream MarketPlace is built to support rapid-response finance. With over 50 planning, reporting and productivity solutions available, you can simply download and deploy new solutions as your needs evolve.

Here are just a few XF MarketPlace solutions to consider adding to your existing rolling forecasting and/or planning processes:

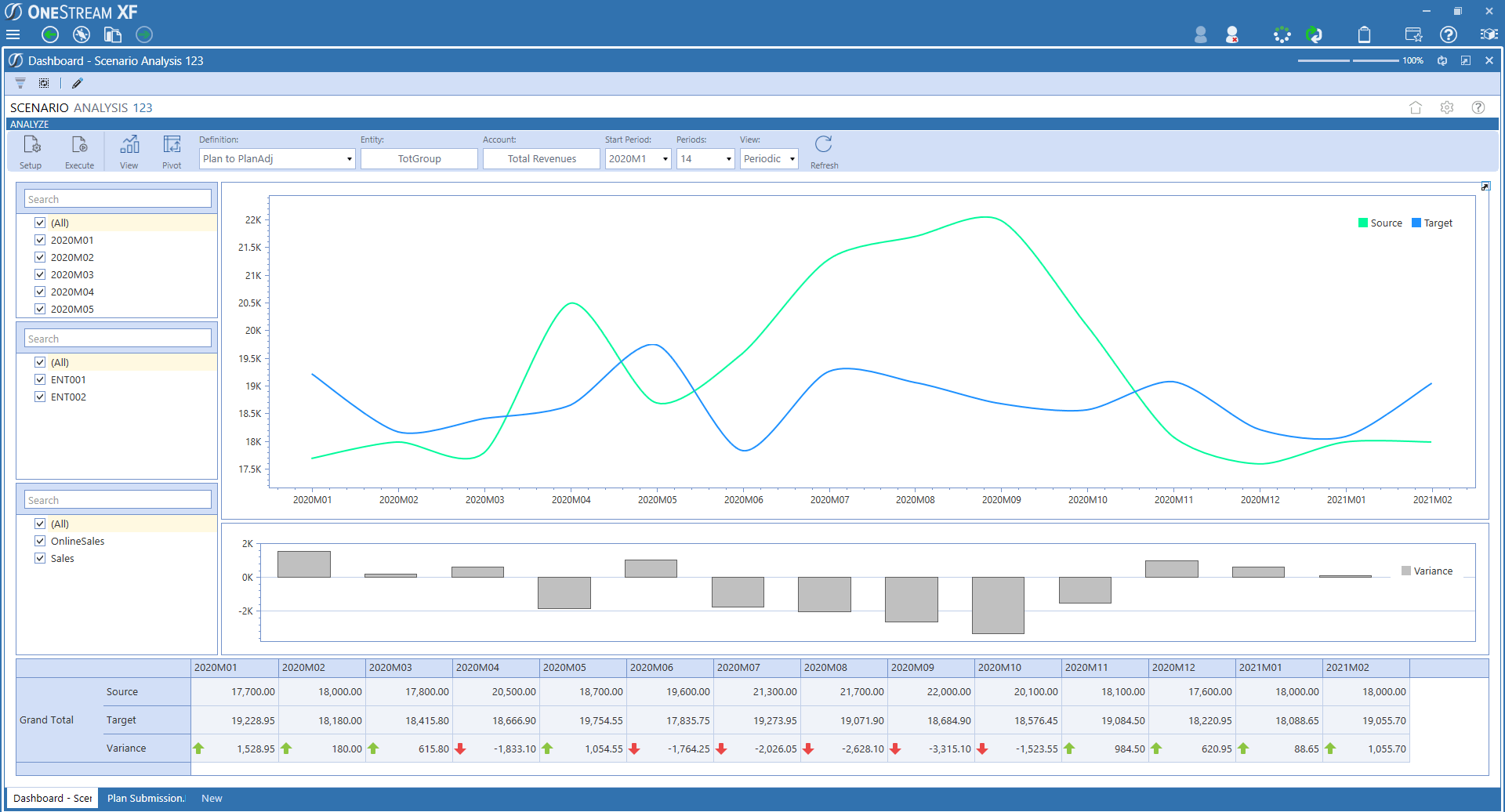

Scenario Analysis 123

OneStream’s Scenario Analysis 123 solution (see Figure 2) enables users to create multiple forecast scenarios on the fly, which is helpful for analyzing opportunities and risks without requiring a full bottom-up forecast.

Users can quickly model and analyze changes to key business drivers over a discreet time period. Scenario Analysis 123 then “flexes” these changes across the chart of accounts and the financials, which gives leadership visibility into profit margin % and the impact on cash flow and other metrics. Finance teams can then track performance against multiple scenarios and/or seed new bottom-up forecasts with new scenarios.

Figure 2: OneStream’s Scenario Analysis Solution

Thing Planning

OneStream’s Thing Planning solution allows users to plan “anything” at the granular business-driver level, such as projects, events or travel or by detailed product lines. Why’s that important? Rather than working as fragmented tools or connected plans, all MarketPlace solutions live on the OneStream platform, which means they’re not only unified with workflows and key tasks but also aligned dynamically to the P&L, balance sheet and cash flow plans.

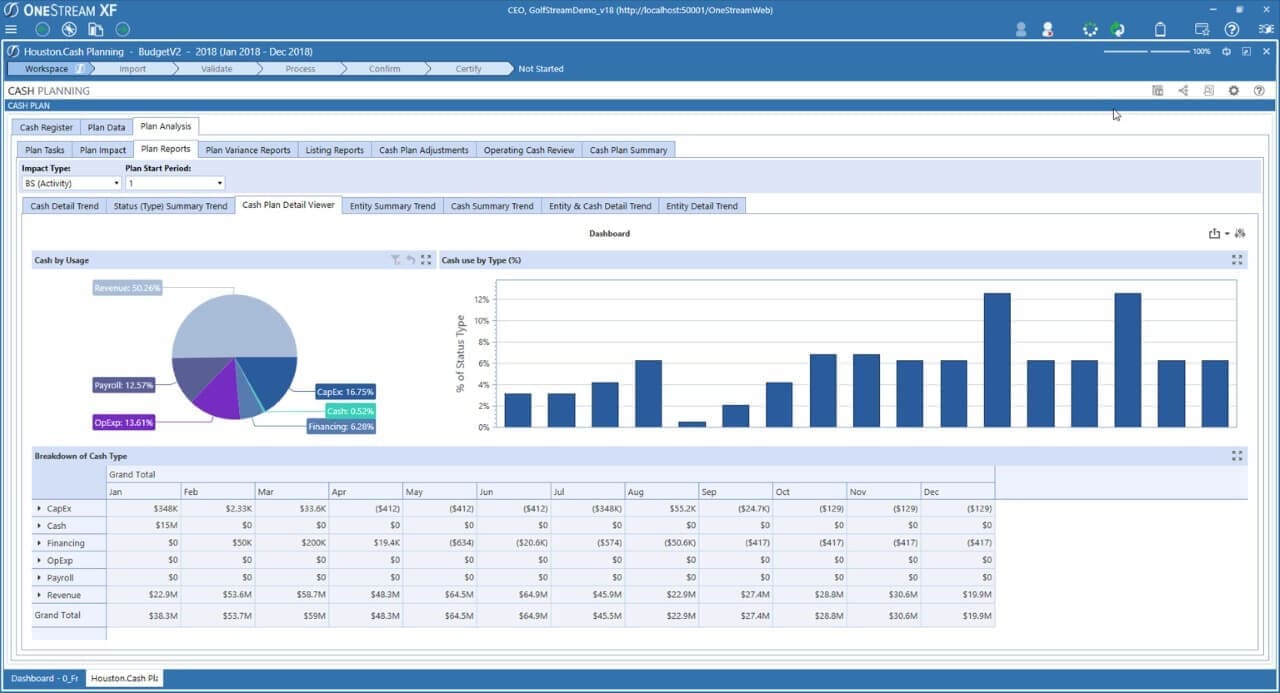

Cash Planning

Cash Planning (see Figure 3), also from the XF Marketplace (see Figure 3), is ideal for supporting rolling forecasts. Users can choose to deploy a driver-based top-down approach or a more granular 13-week bottom-up forecast. Importantly, because OneStream is completely unified, users can align the P&L, the balance sheet and detailed business drivers directly into cash-flow plans.

Figure 3: OneStream’s Cash Planning Solution

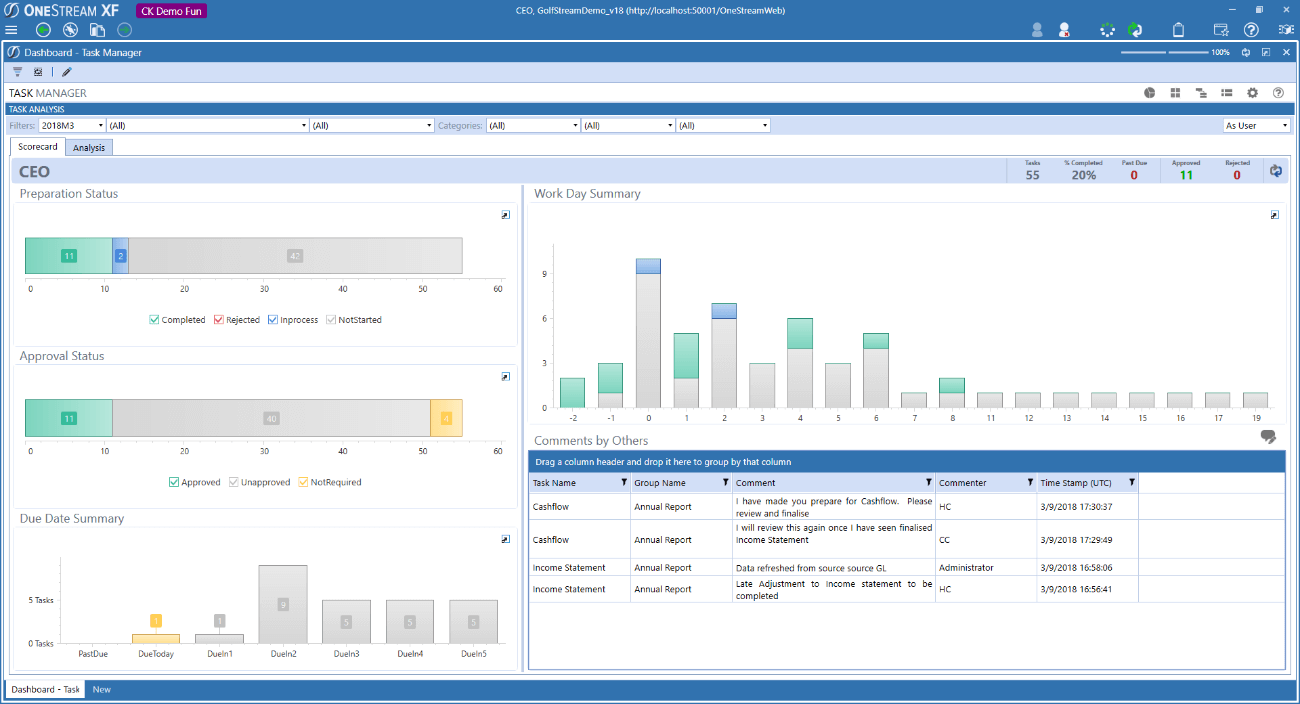

Keep Forecasts Rolling with Task Manager

Every rolling forecast starts and ends with great collaboration. Easy to say, right? Sure is. But for those who actually manage the process, you know how hard it is to drive execution and accountability.

Task Manager (see Figure 4) helps forecast owners organize and manage end-user tasks across virtually all aspects of financial and operational planning & reporting. With built-in dashboards and scorecards, Task Manager gives owners ask-level visibility. And with built-in messaging, Task Manager provides an effective means to proactively collaborate on upcoming deadlines and overdue tasks.

Figure 4: OneStream’s Task Manager Solution

Don’t Let Perfection Stop Progress

Now are you ready to finally ditch the AOP? Whether or not your organization is ready to make the leap, what matters most is to start taking steps to lead at speed – to provide a foundation for your Finance team to power the needs of today and tomorrow. And while nothing challenging is achievable overnight, remember that you’ll never be able to guide the path forward without a plan.

To learn more about OneStream’s Rapid-Response Solutions, download our latest solution brief here.

[1] COVID 19: FP&A Professionals Expect a Painful, Slow Recovery

Get Started With a Personal Demo