In today’s volatile and sometimes disruptive economic environment, CFOs and finance organizations must lead organizational decision-making processes with insight, speed and confidence. Yet many finance organizations are still bogged down by inefficiencies in routine processes such as the period-end financial close and reporting cycle, making it difficult to shift time to value-added analysis and decision support.

Many organizations struggle in managing this complex process with spreadsheets and manual work, or legacy financial applications that are inflexible and no longer meet current business requirements. Read on to learn about the challenges of the financial close, consolidation and reporting process, the software tools that are available and the results organizations are gaining by using modern, cloud-based software applications that are purpose-built to conquer the complexity of the financial close.

Navigating the Complexity of the Financial Close

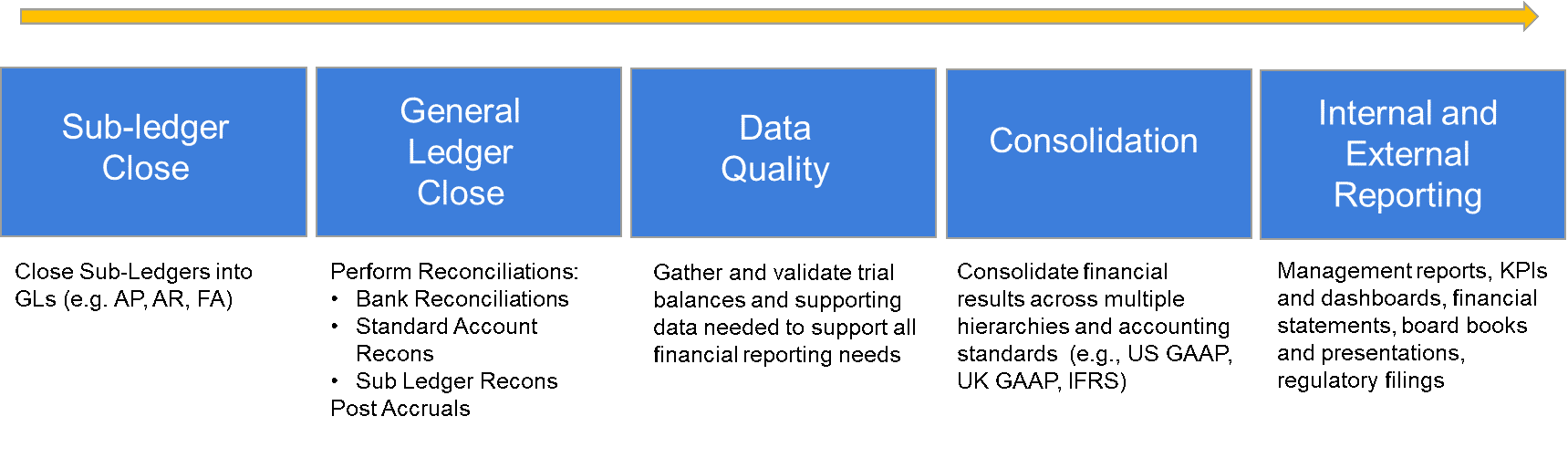

The financial close, consolidation and reporting process can be relatively easy in a small enterprise using a single, centralized GL/ERP system, a single currency and a simple legal entity structure. As organizations grow and evolve in sophistication, however, the process can become quite complex. In a mid-sized to large enterprise, the financial close, consolidation and reporting process spans the following activities (figure 1):

Figure 1: The Financial Close, Consolidation and Reporting Process

Navigating through these steps becomes more challenging based on the size and complexity of the enterprise. Factors that increase the complexity of the process include the following:

- Number of GL/ERP data sources that must be integrated

- Number of currencies that must be translated

- Level of intercompany activity and transactions that must be eliminated

- Complexity of ownership structure (i.e., joint ventures and partial ownerships)

- Number of journal adjustments required

- Number of accounts that must be reconciled

- Complexity of the tax provision across geographies and countries

- Number of reporting standards that must be supported (e.g., US GAAP, IFRS, GASB etc.)

- Types of reporting and number of stakeholders (e.g., management, financial, statutory)

How long does it take organizations to execute the financial close and reporting process? Well, according to the Ventana Research 2019 Office of Finance Benchmark, roughly half (52%) of the companies surveyed close their books within six business days. This figure represented a slight improvement over the 2014 benchmark survey, in which 43% were completing the financial close process in six days or less.

While this is good news, the bad news is that 25% of organizations surveyed take 11 business days or more to close the books. Worse yet, 24% take seven to 10 business days. In other words, there’s plenty of room for improvement.

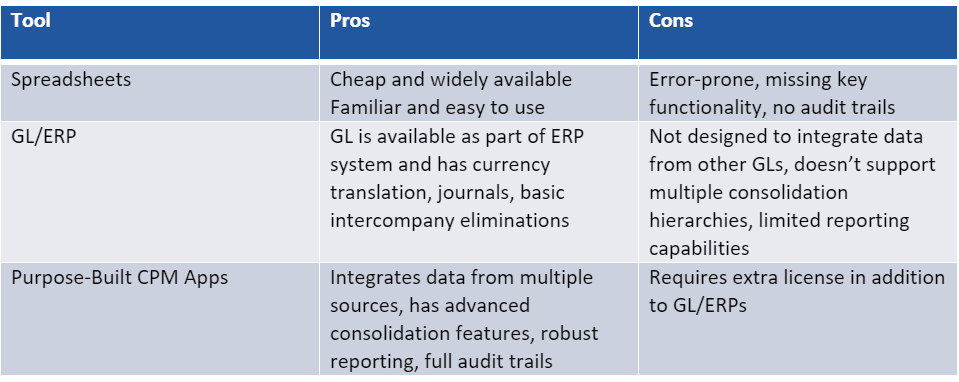

Software Options and Trade-Offs

There are several types of software tools available to support the financial close, consolidation and reporting process. Below (figure 2) is a brief summary of three primary options – spreadsheets, GL/ERP systems and purpose-built applications.

Figure 2: Software Tools and Trade-Offs

Purpose-built financial close, consolidation and reporting applications found in today’s corporate performance management (CPM) software solutions are becoming the preferred approach for mid-sized to larger enterprises. OneStream XF is a good example of a purpose-built application for financial close, consolidation, reporting and more.

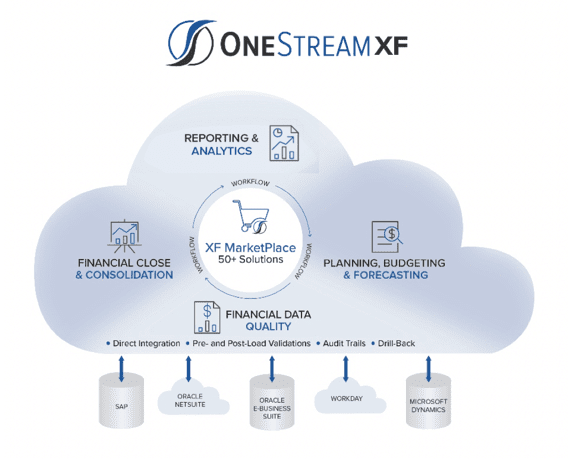

OneStream’s Unified SmartCPMTM Platform

OneStream software provides a modern, unified SmartCPMTM platform that simplifies financial close and consolidation, planning, reporting, analytics and financial data quality for sophisticated organizations. Deployed via the cloud or on-premise, OneStream’s unified platform enables organizations to modernize finance, replace multiple legacy applications and reduce the total cost of ownership for financial systems. OneStream unleashes finance teams to spend less time on the mechanics of managing finance processes and more time focusing on driving business performance.

Learn More

Organizations that have adopted modern, cloud-based applications for financial close, consolidation, reporting, and other processes, have been more successful in streamlining the process, ensuring the accuracy of their financial results. And perhaps most importantly, such organizations have gained the agility needed to adopt quickly to changing business and industry requirements. To learn more, download the OneStream white paper “Streamlining the Financial Close, Consolidation and Reporting Process.”

Get Started With a Personal Demo