OneStream’s Machine Learning Strategy: A Framework for Predictive Finance

Whether it’s the global pandemic, US-China trade wars, Brexit or the 2020 US presidential election, finance teams are keenly aware of what many pundits hate to admit; uncertainty IS the new normal. And though COVID-19 is a black-swan event, navigating through uncertainly is nothing new for finance leaders. Navigating uncertainty is why long-range planning and rolling forecasting are so vital. But not just to forecast the numbers. Long-range planning and rolling forecasts help facilitate collaboration throughout the organization and increase business agility. How? By sharing insights and exchanging ideas across functions about business risk and opportunities. And of course, by leveraging those to make more effective decisions. You know what else corporate finance leaders agree on?

That predictive analytics and machine learning (ML) can take this to the next level.

New Technologies Becoming Mainstream

Like the exponentially increasing adoption of cloud-based solutions by finance, the adoption of predictive analytics and ML is a matter of when – not if.

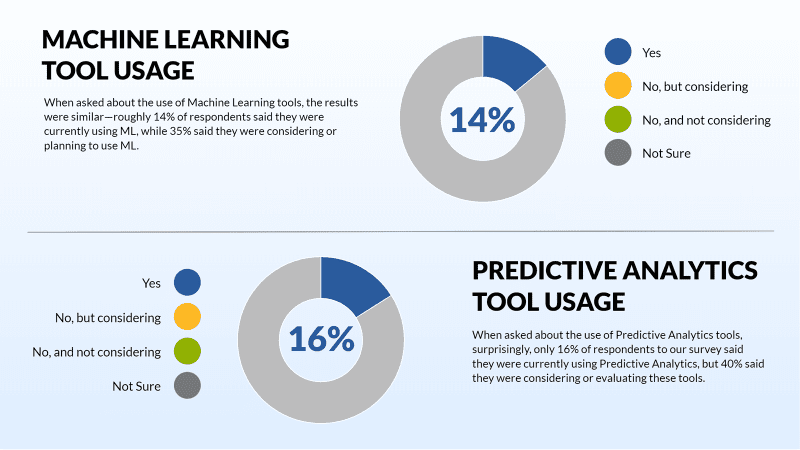

The use of and interest in predictive analytics and machine learning is growing. Want proof? Here are just a few of the results from OneStream’s “Beyond the Hype” Predictive Analytics & Machine Learning Market Survey from August-2019:

- 16% of respondents are currently using predictive analytics; 14% are using ML (see Figure 1)

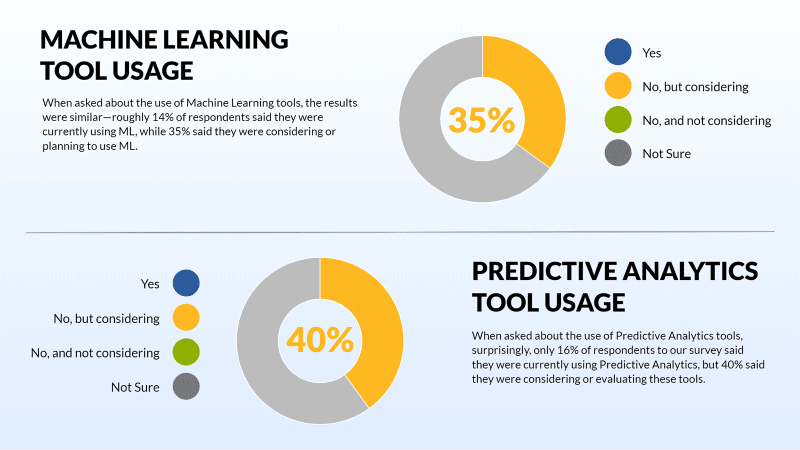

- 40% of respondents are considering using predictive analytics; 35% are considering using ML (see Figure 2)

Why all the interest?

Because finance and operational leaders are looking to supplement their planning processes with statistically significant predictive forecasts in order to compare against business forecasts that may be biased by the fog of uncertainty. How? By helping finance and business leaders to find new ways to ask “why.”

And with a focus on 100% customer success, OneStream is helping finance leaders find new ways to ask why – which is precisely “why” OneStream is dedicated to providing finance leaders with intuitive ways to take advantage of predictive analytics and machine learning no matter where they are in their advanced analytics journey.

Figure 1: OneStream’s Beyond the Hype Predictive Analytics & Machine Learning Market Survey

Figure 2: OneStream’s Beyond the Hype Predictive Analytics & Machine Learning Market Survey

Built-In Predictive Analytics

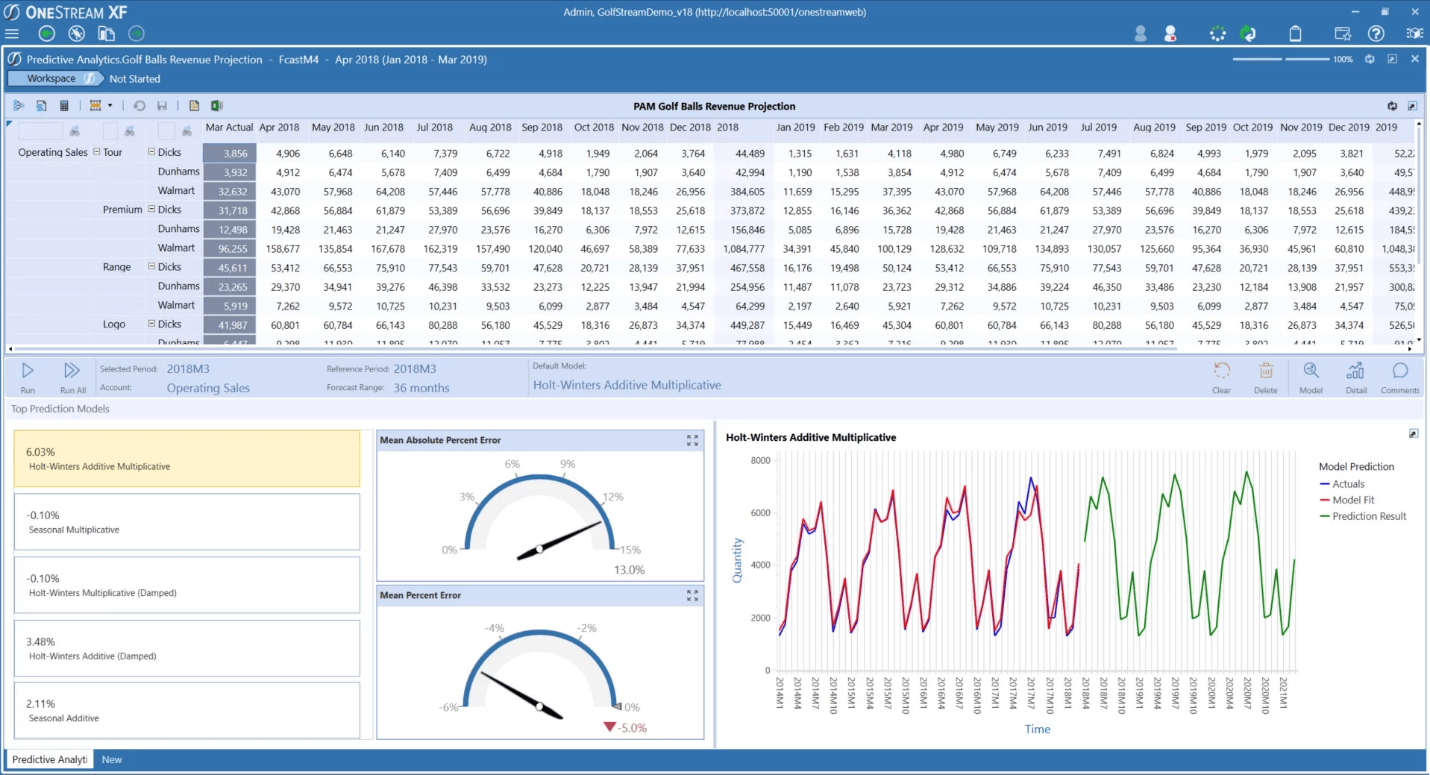

OneStream’s built-in Predictive Analytics solution (see Figure 3) provides end users with the power to predict future performance based on applying predictive algorithms to historical data</st rong>. With predictive analytics, users execute seasonal trend models right from the same interface they already use for planning, forecasting and reporting. How does it work?

Just select the data, click a button and OneStream runs many predictive algorithms and automatically picks the best forecast model based on the data patterns of the historic data selected. Users can then leverage predictive models to create baseline forecasts, validate forecasts submitted by managers in the field, seed forecast scenarios or blend predictive forecasts with business initiatives.

This type of predictive analytics is not new. In fact, the underlying capabilities of predictive models are something many of us learned back in Statistics 101. But by automating model creation directly in the planning interface, OneStream is making predictive modeling easy to execute for any planner.

That “ease of use” makes the solution powerful for finance teams. However, no predictive algorithm is going to predict with 100% accuracy. Why not? The answer is human intuition and business acumen.

Figure 3: OneStream’s Predictive Analytics 123 Framework

Unlimited Forecasting with Machine Learning (ML)

For finance teams that need to go beyond traditional predictive analytics, ML is the answer. Why? Because ML is where people and technology come together. Here are a few examples to consider:

- Feature engineering: Feature engineering is the process of taking raw data from various sources, organizing it and transforming the data into a numerical format that ML models can understand. Feature engineering requires domain expertise (e.g., human intuition) to ensure features are both relevant and help increase the accuracy.

For example, consider a retailer’s demand forecast for product A in region B within store C. To forecast at this granular level, there are so many other factors to consider. How about the weather in region B, for instance? And what if store C built a new parking garage? Or what if a major competitor opens a location across the street or materially changes pricing? Factors like these are all potential features an ML model might consider.

- Model training: The process of taking a set of data and letting the computer determine whether there’s any relationship between the dataset features and the target variable (forecast item).

- Retraining: As new data is available, models then retrain. Why? So they can learn, improve and continually optimize to produce the best forecast.

ML IS the new frontier for finance on the journey into advanced analytics.

And to support this journey, OneStream is taking an agnostic approach to ML. We understand that data scientists want to use the tools with which they’re most comfortable.

Connecting ML to CPM with OneStream

OneStream’s strategy is to provide an accessible ML framework for our customers that’s unified with corporate performance management (CPM) processes. Here’s a quick summary of our two-tiered approach:

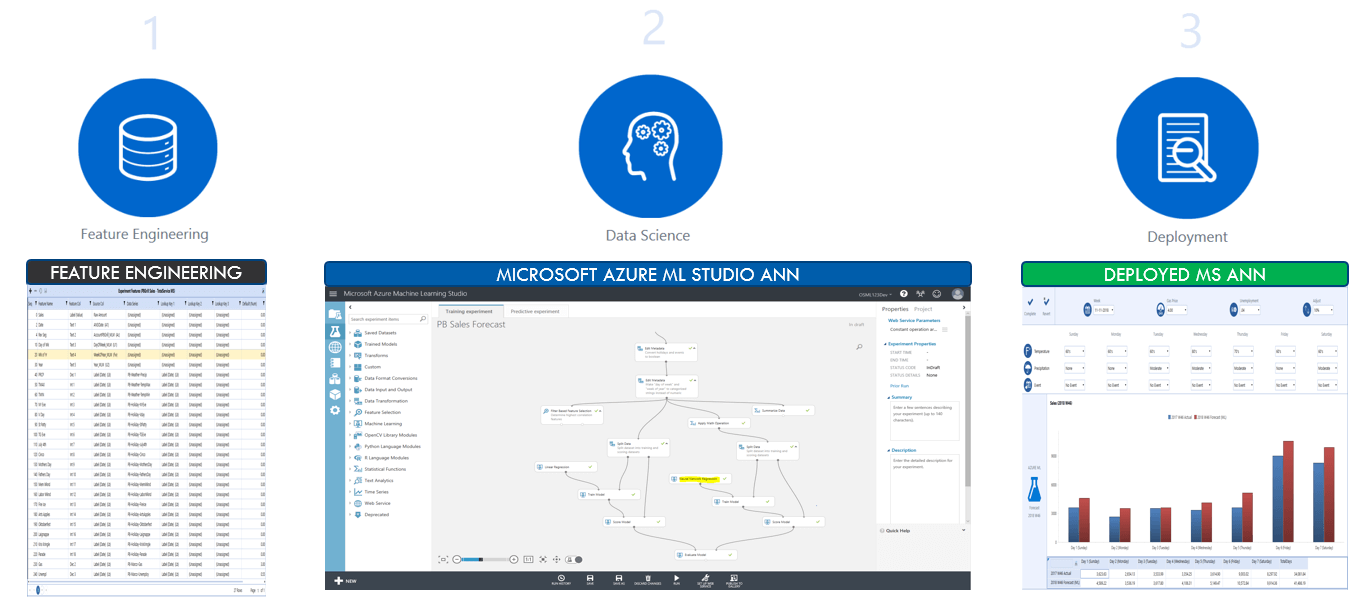

For organizations with data science resources:

- Seamless Integration with ML Engines (see Figure 4) – will provide powerful and seamless integration with data scientist projects and link that back into core finance processes.

- Step 1: Leverages our advanced data preparation engine to assist with feature engineering, such as incorporating gas prices, weather patterns and the impact of holidays.

- Step 2: Integrate data from Step 1 with OneStream’s ability to integrate with 3rd party ML platforms to allow data science teams to use their tools of choice. For example, Figure 4 illustrates OneStream’s integration with Azure ML.

- Step 3: Finally, integrate the output from the ML models back into the OneStream users’ workflow, enabling data scientists to deliver ML models directly into the planning and reporting process.

Figure 4: OneStream’s ML Integration

For organizations without data science resources:

- Guided ML Modeling – OneStream is currently developing a guided ML experience, which will give finance teams the power to leverage ML models without the data scientist. This solution will take users through a step-by-step process through each part of the ML model building and deployment process, including feature engineering through advanced algorithm configuration, training and deployment. Here’s how it works:

- Data Load and Tagging: Guided ML gathers information about the columns in the source dataset and other additional data (such as geographic data) from users.

- Forecast Horizon and Scheduling: Users are prompted to input their proposed forecast horizon.

- Feature Generation/Engineering: Guided ML generates new features using internal factors like volume, revenue as well as external factors like weather and GDP.

- Baseline Model Comparison: Guided ML compares ML models with traditional forecasting methods, like grossing up prior-year results, to calculate incremental forecast accuracy.

- Model Training and Deployment: Guided ML automatically trains, tunes, and deploys the best performing ML model.

- Model Presentation: All model results and insights are tracked and presented to users however they choose within their normal OneStream planning processes.

Just like the integrated ML solution, the guided ML experience is designed to enable finance teams to focus on collaborating with their business partners. This allows finance teams to leverage new insights to find new ways to ask why and extend their dialogue to make better decisions.

Putting Advanced Analytics to Work

Will machine learning and predictive analytics eliminate all the uncertainty in the world today? Absolutely not. Nor will these technologies change the Office of Finance forever. But they do offer capabilities that every finance team needs to have ready in their arsenal to provide model scenarios that not long ago we never dreamed would be necessary.

And like we’ve done for each of our 500+ customers around the globe, OneStream’s mission of delivering 100% customer success ensures finance teams will have what it takes to lead the charge.

Learn More

To learn more about Predictive Analytics and ML, download our latest video interview with OneStream CEO Tom Shea.

Get Started With a Personal Demo