Demand Planning is a critical piece of the overall Sales and Operations Planning (S&OP) process. In fact, ensuring S&OP practitioners and Financial Planning and Analysis (FP&A) practitioners can use a common language is important to driving both operational and financial performance. How? One effective way is to leverage the financial and operational planning insights within corporate performance management (CPM) software that align the data and KPIs from both worlds – which allows for driving continuous collaboration across the enterprise planning processes. Aligning these operational and financial KPIs ultimately elevates FP&A to next-generation Finance with eXtended Planning and Analysis (xP&A).

Aligning Operational and Financial Plans Drives Financial Performance

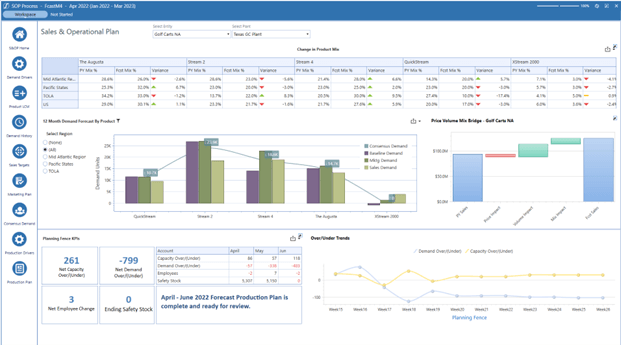

Everything in an organization has financial implications. If the S&OP forecast (see Figure 1) inaccurately accounts for how much material is needed to meet demand, for instance, then inventory holding costs and obsolescence issues may increase. Additionally, if too little material is available to meet demand, then costly rush shipping can impact the bottom line and cash flow.

Today, uncertainty across the global economy is drastically impacting consumer demand, affecting commodity prices, and disrupting supply chains. Amid such volatility, FP&A teams must help enable and accelerate decision-making processes such as Demand Planning. Where to begin?

5 Demand Planning KPIs for Better Financial Results

For FP&A professionals, understanding and utilizing the KPIs from the Demand Planning process creates a common language to unify key processes and drive both operational and financial performance.

Here are 5 Demand Planning KPIs that can inform better financial results.

1. Inventory Turnover

How quickly is inventory being turned over? As inventory sits, inventory holding costs increase and obsolescence becomes more likely. Obsolescence issues can then result in scrapped material and money lost as more material must be procured to replace the obsolete material – likely at a higher cost for rush shipping and spot procurement. And with disruptions to global supply chains and shipping channels, issues that can arise in this domain can cause a heavy financial burden and managerial headaches.

This important metric in the demand planning cycle helps assess the health of the supply chain organization, the variables affecting demand, and the ability to satisfy the demand in time. Considering the financial planning cycle is crucial because it impacts the budgeting, planning, and forecasting cycles. Accordingly, bridging the gap between the operational and financial plans can ensure lockstep in the various planning efforts happening across large and complex organizations.

2. Total Sales

Finance professionals are acutely aware of the important role total sales plays in the FP&A planning and budgeting cycles, but the S&OP process also looks closely at this metric. Sales numbers are essential to understanding the bigger picture. Specifically, the numbers show how the supply chain and operations are ultimately performing when it comes to fulfilling orders and keeping customers happy – which ultimately generates sales for the organization.

In other words, the goal is to align financial planning inputs with the results of the operational planning processes happening as part of the S&OP process. That alignment ensures that Finance and Operations are moving in lockstep to measure and achieve organizational goals.

3. On-Time Delivery

Organizations must analyze their supply chains and ensure their teams are delivering products on time to reduce inventory holding costs and ensure customer expectations are being met. If this isn’t happening, a supply chain issue likely exists and needs to be addressed.

This issue affects more than just the supply chain, however. Like inventory turnover, on-time delivery metrics are important to understand in the demand planning process and can also help inform the financial planning process. Finance cares about the impact on financial metrics when customers aren’t happy and therefore aren’t placing orders or, even worse, when the company becomes liable for unmet deliverables and expectations.

4. Gross Margin

Is gross margin hitting projected targets? If not, why? Understanding gross margin, which is net sales minus cost of goods sold, and tracking performance against projections matters to both a supply chain organization and Finance.

Forecasting customers and demand volume is a supply chain activity that can map gross margin projections. And for the Finance group, utilizing the outcome of that activity informs on how to forecast gross margin at the enterprise level.

5. Working Capital Projections

As everyone knows, cash is king, so asking whether the company has as much cash in the bank as the team forecasted is important. Understanding how much money and what assets are needed to run day-to-day operations matters just as much to operational planning as it does to Finance. For instance, incorporating the S&OP insights into a 13-week cash flow strategy ensures liquidity – something that is as important as ever with economic conditions becoming more uncertain.

Working cross-functionally with the Operations team and the Finance team ensures all efficiencies in the process and operations are being explored. Cross-functionality also ensures the financial implications of those efficiencies are being folded into the financial and operational plans.

Final Thoughts

Ultimately, aligning these key KPIs in the plan and tracking them across operational and financial reporting ensures that the organization can sense issues before they impact the financial results and saves time by ensuring effort isn’t duplicated across the planning processes within an organization. These time savings translate into more time available for generating useful insights and analytics.

Ensuring alignment with the ongoing financial planning efforts is critical to driving financial and operational performance. Utilizing the shared language and KPIs between Operations and Finance helps bridge the gap between the efforts and gets the plans closer to a single, unified plan for the organization to work toward and track progress against.

Learn More

Want to learn more about why unifying FP&A and demand planning are critical to driving performance? Check out a recording of our Live Demo: Aligning S&OP and FP&A for Intelligent Demand Planning to hear more about demand planning in OneStream.

Get Started With a Personal Demo