As modern Finance leaders navigate the turbulent global landscape, the path ahead for Financial Planning & Analysis (FP&A) gets clearer every day. A pivotal shift is occurring, emphasizing the need to unify connected planning to foster alignment between Strategy, Finance and Operations. Not too long ago, however, the ambitious vision of integrating financial and operational planning into a seamless ecosystem faced setbacks due to technological limitations. The rapid advancements in planning processes outpaced the supporting technology – a predicament many businesses might recognize.

But here’s the truth: organizations now stand at a crossroads – embrace unified connected planning or risk incurring hidden costs.

Despite technological advances and increased data accessibility, Finance is still struggling to synthesize all planning across the enterprise into one cohesive and ongoing process. In fact, according to a 2023 report from the American Productivity and Quality Center (APQC), only 26% of CFOs surveyed say their respective company’s approach to annual budgeting is valuable. Plus, even the CFOs themselves admit that improvements are needed

Today’s Finance leaders must maintain board, investor and stakeholder confidence while providing actionable insight to line-of-business managers. To do so, CFOs and Finance managers must, now more than ever, deliver fast, accurate and valuable financial and operational information that can be trusted.

Finance leaders can now leverage modern technology to rid themselves of legacy systems and processes while embracing future trends prevalent in today’s market.

Key Trends Shaping Modern FP&A

Spurred by technological advances, the speed of analytical disruption in organizations is already perpetually fast – and only getting faster. As Finance groups prepare for the transformation ahead, 3 key trends are reshaping the future of how organizations will generate value from reporting and analytics initiatives:

Key Trend #1: The Rise of eXtended Planning & Analysis (xP&A)

As Finance teams respond to a rapidly changing business environment, FP&A is extending its reach to include and collaborate with Sales, Marketing, Supply Chain, Talent Management and IT to accelerate enterprise agility. This unifying framework – known as eXtended Planning and Analysis (xP&A) – enables continuous collaboration and performance management by using a single, composable platform and architecture.

Key Trend #2: More Targeted Analytics

Financial analysts and decision-makers are drowning in complex data. To better process that data, organizations are increasingly enhancing traditional dashboards with dynamic data-driven insights powered by artificial intelligence (AI) and machine learning (ML). The resulting dynamic data stories generate insights as narratives, highlighting the most meaningful changes in the business for each user – with root causes, predictions and prescriptions for the roles and contexts. In turn, the enhanced data-driven insights reduce the risk that financial and operational analyses will be misinterpreted.

Key Trend #3: AI-Enabled FP&A

The way Finance teams manage the data behind dashboards and visualizations is changing. How? Finance can use modern technologies to deploy a host of new models and tools to provide actionable financial and operational data that drive effective decision-making. More specifically, technologies such as ML and AI are leveraged to automate various tasks required during the analytics process – and to discover, visualize and narrate important findings in vast data sets. AI and ML ultimately enable Finance to reduce the time it takes to perform the day-to-day input- and output-focused activities that consume analysts’ time – without requiring the full-time support of data scientists. (See Figure #1)

As organizations navigate the ever-evolving landscape, staying ahead of the curve is paramount to success. While the adoption of modern technologies and embracing key trends can bolster an organization’s financial agility, there comes a crucial juncture when scaling connected planning becomes imperative. Recognizing the signs that indicate the right time for this strategic move can make all the difference in propelling a company towards its goals and sustaining growth.

5 Signs It’s Time to Scale Connected Planning

The continuous sophistication of organizations makes it challenging to harness technology to bolster Finance. When those challenges are coupled with the pressures of volatile revenue streams, Finance leaders are tasked with managing growth, optimizing emerging technologies, addressing globalization demands, evolving target operating models and empowering mobile employees. These leaders must also explore innovative avenues to boost productivity, optimize costs and maximize the value of relationships.

If your organization is evaluating whether it’s ready for Finance Transformation, here are 5 key signs it’s time to scale connected planning.

Sign #1 Increasing Complexity and Data Volume

One clear indicator that it’s time to scale your connected planning efforts is when your organization experiences a significant increase in complexity and data volume. As the business grows, you’ll likely encounter more intricate planning challenges that cannot be effectively addressed with traditional planning methods. Instead, scaling your connected planning capabilities will allow you to leverage advanced analytics and data integration to handle complex planning scenarios, accommodate large data sets and gain deeper insights into business operations.

Sign #2 Lack of Coordination and Collaboration

Disconnected FP&A planning processes often result in silos, leading to a lack of coordination and collaboration between different departments. If you notice your teams are struggling to work together, duplicate efforts or encounter difficulties aligning plans, those signs are a clear indication you need to scale your connected planning efforts. By implementing an integrated planning solution, you can break down departmental barriers, encourage cross-functional collaboration and ensure everyone is working toward a shared set of goals.

Sign #3 Inefficient Planning Cycles

Are planning cycles taking longer than necessary, causing delays in decision-making and hampering your ability to respond swiftly to market changes? If so, those signals are telling you the time is now to scale your connected planning efforts. Automating and streamlining your planning processes through connected planning will reduce manual work, eliminate redundant tasks and significantly speed up your planning cycles. In turn, this increased efficiency allows you to make informed decisions faster and stay ahead of the competition.

Sign #4 Inaccurate Forecasts and Poor Performance

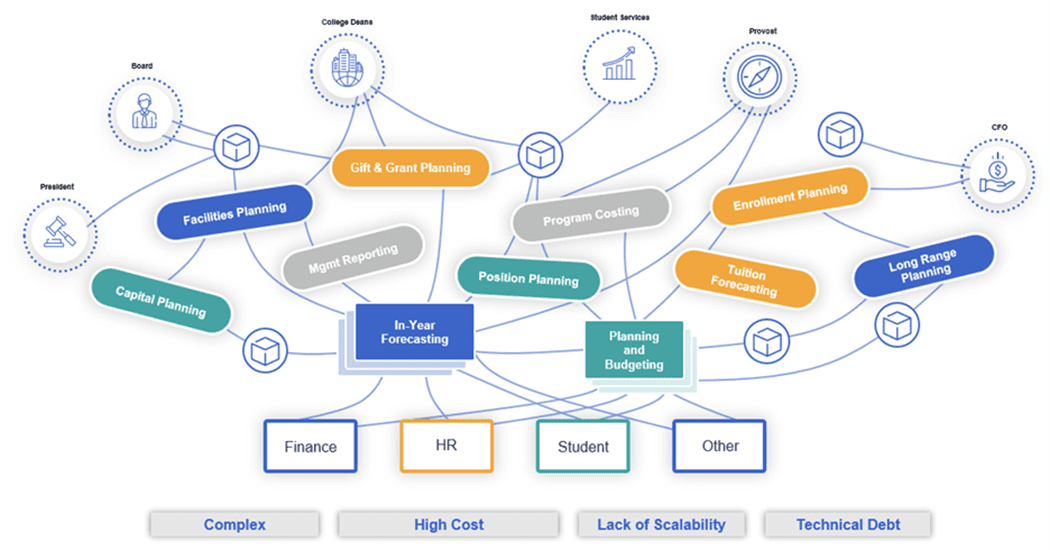

If your FP&A organization is consistently struggling with inaccurate forecasts or failing to meet performance targets, your planning processes may be falling short. (See Figure #2) Scaling connected planning can help you improve forecast accuracy by leveraging real-time data and advanced forecasting models. With access to up-to-date information and robust predictive capabilities, you can make more reliable projections, identify potential risks and opportunities, and take proactive measures to achieve better performance outcomes.

Sign #5 Limited Scalability and Adaptability

As your business expands and evolves, you need planning processes that can scale and adapt accordingly. Traditional FP&A planning methods often lack the flexibility to accommodate growth or respond effectively to market shifts. scaling connected planning enables you to handle increased demand, seamlessly integrate new business units or acquisitions, and adjust your plans to align with evolving market dynamics. Scaling therefore provides the scalability and adaptability needed to support your organization’s long-term growth strategy.

Conclusion

Connected planning is a powerful approach that can revolutionize how your organization manages its planning processes. Recognizing the signs that it’s time to scale your connected planning efforts is crucial for staying competitive in today’s fast-paced business environment. And by addressing increasing complexity, fostering collaboration, improving efficiency, enhancing forecast accuracy and enabling scalability, you can unlock the full potential of connected planning and propel your organization toward greater success. Embrace the opportunity to scale connected planning, and watch your business thrive in the face of changing landscapes.

Learn More

To learn more about how organizations are scaling connected planning, click here to read our whitepaper on the topic. And if you’re ready to take the leap from spreadsheets or legacy CPM solutions and start your Finance Transformation, let’s chat!

Get Started With a Personal Demo