Whenever Groundhog Day (Feb. 2nd) comes around it reminds me of that 1993 movie of the same name. Do you remember it? Just for a quick refresher, Bill Murray plays an arrogant weatherman covering Groundhog Day in Punxsutawney, PA who finds himself in a time loop where Groundhog Day is repeated over and over.

Mr. Murray eventually breaks the cycle by changing his ways. But this situation also reminds me of how many Finance professionals must feel regarding their organization’s financial close process. I lived this myself for many years when I was an accountant early in my career. Finance and Accounting staff are often stuck in the same financial closing routine, month after month.

They struggle with spreadsheets or inadequate financial close, consolidation and reporting systems, and time-consuming manual tasks. When it takes 2 weeks or more to close the books, by the time Finance delivers management reporting it’s often too late to have an impact. Then there’s limited time available to focus on value-added analysis before the next monthly closing starts again.

Modernize Systems and Automate Financial Processes

The monthly financial close and reporting process doesn’t have to be like Groundhog Day. By modernizing financial systems and automating financial close tasks and processes, Accounting and Finance can streamline the close process, accelerate delivery of financial statements, and spend more time on analysis and supporting decision-making. Here are some examples of key tasks that can be streamlined through financial close process automation. These include:

- Collecting and validating trial balances – many corporate Finance teams spend several days each month chasing down general ledge trial balances, validating researching, and correcting errors with division or regional accountants. With a modern financial consolidation system, accountability and ownership for submitting and validating trial balances can be pushed to Finance staff at divisional or regional levels. With a fast and accurate financial data integration and collection process, corporate Finance staff can focus more time on consolidating and reviewing results vs. loading data.

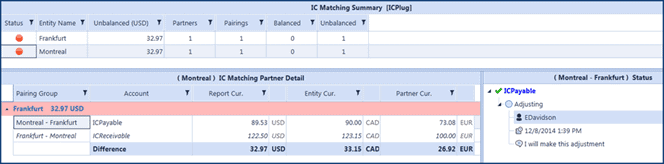

- Intercompany eliminations – this is another critical task that often adds extra days to the financial close process as corporate Finance staff spend too much time trying to reconcile intercompany balances and getting divisional and regional Accountants to correct their intercompany accounts. With a modern financial close and consolidation system, the responsibility for communicating and confirming intercompany charges and balances between divisions or regions can be pushed down to the operating levels, with intercompany eliminations being automated and only minor exceptions needing the attention of corporate Finance.

- Currency translations – because of the complexities of collecting and reporting financial results in multiple currencies, many organizations collect financial results from across the enterprise in only a reporting currency, such as US Dollars. Then to understand the impact of FX rates on their financial results, they have to spend extra time collecting additional data and performing this analysis. With a modern financial close and consolidation system, general ledger trial balances can be submitted in local currencies, translated to the reporting currency, and consolidations can occur in multiple currencies, with a full analysis of the impact of fluctuating FX rates on financial results.

- Allocations – performing cost allocations that are required during the financial close process can be tedious when using spreadsheets, given the iterative nature of the process. With a modern financial close, consolidation, and reporting solution, cost allocations can be automated, and updated as the financial statements are updated over the course of the financial closing cycle.

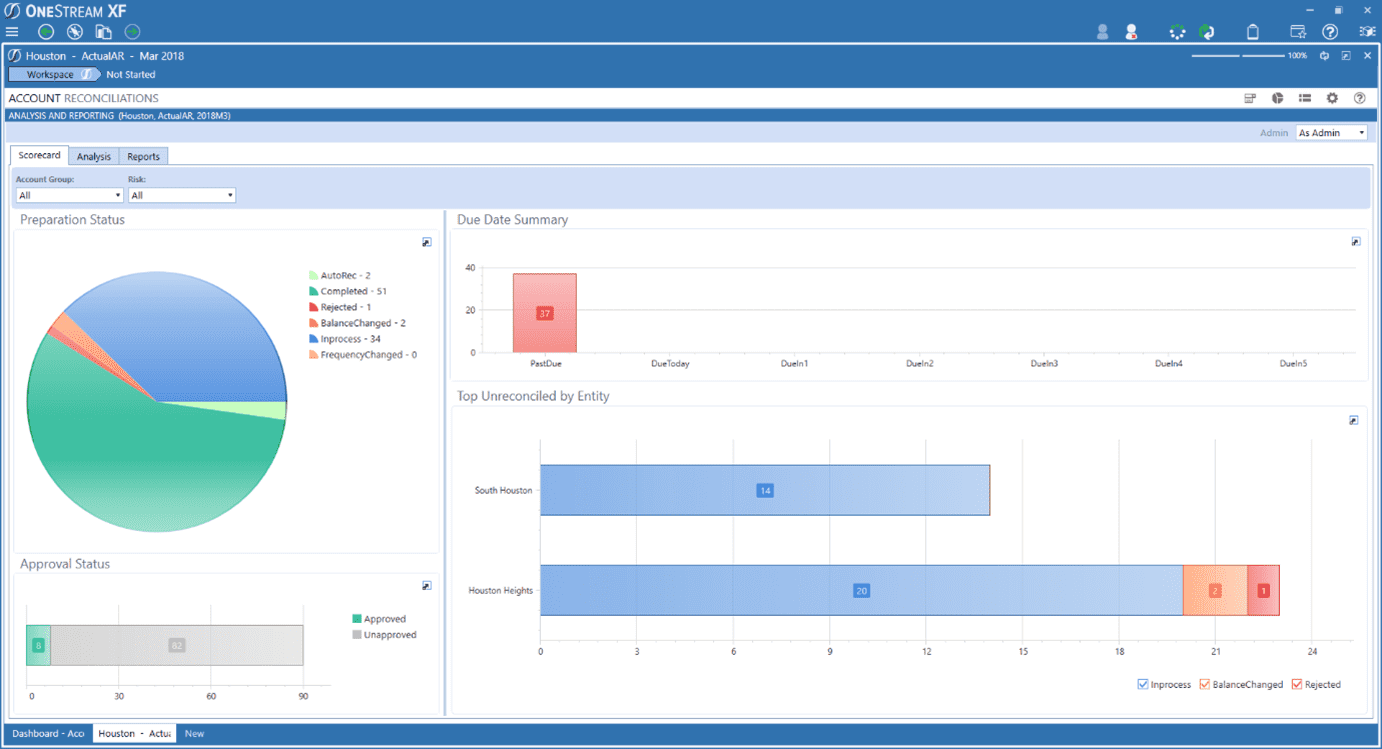

- Account Reconciliations – Finance teams in mid-sized to large enterprises can have hundreds to thousands of account balances that need to be reconciled before the financial statements can be finalized at month-end, adding extra days to the financial close process. With a modern account reconciliations software solution, that integrates seamlessly with the financial consolidation software, the account reconciliations process can be more automated and streamlined significantly.

- Management and Financial Reporting – while collecting and consolidating financial results often consume most of the time in the monthly close process, generating financial reports for management and external stakeholders can also consume a lot of Finance time, especially when using spreadsheets. With a modern financial consolidation and reporting solution, that includes integrated and Finance-friendly reporting tools, the production and distribution of management and financial reports can be largely automated, accelerating delivery and providing more time for Finance to perform value-added analysis.

Simplify and Unify Financial Close, Consolidation, Reporting, and More with OneStream

Many organizations have modernized Finance and automated the financial close process using OneStream. OneStream provides a revolutionary corporate performance management (CPM) solution, the OneStream Intelligent Finance platform. OneStream unifies and simplifies financial close, consolidation, planning, reporting, analytics, and financial data quality for sophisticated organizations.

Deployed in a secure, scalable cloud environment, OneStream is the first and only solution that delivers corporate standards and controls, with the flexibility for business units to report and plan at additional levels of detail without impacting corporate standards – all through a single application.

Built upon twenty years of creating industry-leading financial close management, consolidation, and financial data quality solutions, our unique platform delivers more complete functionality in a solution that is easier to own and maintain. OneStream supports strict compliance requirements with comprehensive audit controls on data, metadata, and processes. Our financial consolidation and reporting solution includes key capabilities that help streamline the close process, including:

- Global consolidation capabilities (US GAAP, IFRS, Multi-GAAP)

- Advanced currency and cash flow reporting

- Powerful intercompany eliminations

- Integrated financial data quality

- Detailed audit trails and drill-through

- Guided workflows, guided reporting, and dashboards

- MS Office integration including Excel, Word, and PowerPoint

The OneStream MarketPlace features downloadable solutions that allow customers to easily extend the value of their CPM platform to quickly meet the changing needs of finance and operations. Key MarketPlace solutions that complement our financial close, consolidation, and reporting capabilities and help organizations reimagine the financial close include:

- Account Reconciliations

- Transaction Matching

- Task Manager

- Compliance Solutions

- Parcel Service and others

In addition to providing the most advanced financial consolidation and reporting in the market, the OneStream platform also supports budgeting, planning, forecasting, and analytics. So there’s no need to integrate data between separate consolidation vs. planning and analysis applications or modules. All these capabilities live and work together in a single, unified platform.

Break the Cycle

Organizations that have adopted OneStream have accelerated their period-end financial close and reporting cycles, improved data quality, shifted more Finance time to value-added analysis, improved management insights and decision-making.

Kiss Groundhog Day goodbye. To learn more download Reimagining the Close white paper and contact OneStream if you are ready to embrace financial close process automation.

Get Started With a Personal Demo