The information technology (IT) market is chock full of many buzzwords and terms that often get used interchangeably. But in some cases, there are subtle differences between terms that are important to understand and that can impact the selection of tools and how they are deployed. One example is the use of the terms business intelligence vs. business analytics or BI vs. BA. Read on to learn how these terms and tools are differentiated and how they complement each other.

Let’s start with a history lesson.

Business Intelligence Emerges from Decision Support

Although there were some earlier usages, business intelligence (BI) as it’s understood today evolved from the decision support systems (DSS) used in the 1960s through the mid-1980s. Then in 1989, Howard Dresner (a former Gartner analyst) proposed “business intelligence” as an umbrella term to describe “concepts and methods to improve business decision making by using fact-based support systems.”

The more modern definition provided by Wikipedia describes BI as “a set of strategies and technologies used by enterprises for the data analysis of business information.” Another definition offered up by TechTarget states that “Business intelligence (BI) is a technology-driven process for analyzing data and delivering actionable information that helps executives, managers, and workers make informed business decisions.”

The TechTarget definition goes on to describe how, as part of the BI process, organizations collect data from internal IT systems and external sources, prepare it for analysis, run queries against the data, and create data visualizations, BI dashboards, and reports to present data and make the analytics results available to business users for operational decision-making and strategic planning.

Business Analytics Takes Over as the Umbrella Term

“Business analytics,” or “data analytics” is the more modern term being applied to the broader domain of BI, corporate performance management (CPM), and analytic tools and applications. What I like about the term analytics is that it denotes a more “active” approach to consuming information. Where BI is often viewed mainly as the process of gathering information and formatting it for delivery to end-users – analytics speaks more to the process of accessing, processing, consuming, manipulating, slicing, dicing, and drilling into the information to understand trends and get answers to analytic questions.

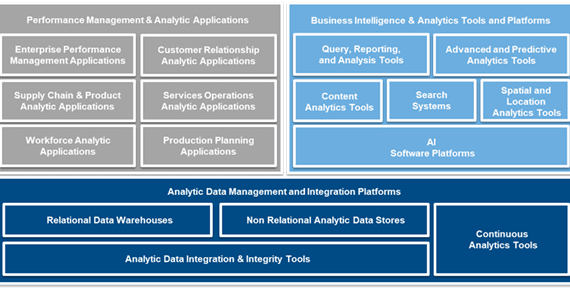

Below is the International Data Corporation (IDC) Taxonomy (see figure 1) for Big Data and Analytics Software, which depicts how all of these tools and applications fit together. There are three primary segments to the market in this taxonomy:

- On the upper left, you’ll see performance management and analytic applications. This includes financial EPM/CPM applications, as well as other analytic applications, such as CRM, supply chain, workforce, and others used across business operations

- On the upper right, you’ll see business intelligence and analytics tools. This includes query, reporting, multidimensional/OLAP, and visual discovery, as well as advanced and predictive analytics.

- Then underlying both of these segments are the analytic data management and integration platforms. This includes data integration tools, as well as data warehousing and management technologies that can serve up data to BI and analytic tools or can be leveraged by performance management and analytic applications.

Business Analytics in Action

With the IDC taxonomy identifying the various types of business analytics tools that are available in the market, let’s talk about the use cases for business analytics. There are essentially three types of analytics that businesses use to drive their decision making:

- Descriptive analytics – tells us what has already happened in the past

- Predictive analytics – shows us what “could” happen in the future

- Prescriptive analytics – informs us what “should” happen in the future

Descriptive analytics make up the majority of today’s management reporting. It’s the analysis of historic data using simple techniques such as data aggregation and data mining, which are used to uncover trends, signals and patterns. This information is delivered to end-users via reports and management dashboards that include visual data representations such as line charts, bar charts and pie charts that provide useful insights and provide the foundation for additional analysis of the underlying details.

Predictive analytics is a more advanced method of data analysis that applies statistical analysis techniques and machine learning to historical data to project future outcomes, and the likelihood of these outcomes. The use cases for predictive analytics include problems such as demand or sales forecasting, fraud detection, and customer churn analysis.

While closely related to descriptive and predictive analytics, prescriptive analytics takes the process a step further by showing decision-makers which future scenario is the best path forward using a variety of statistical methods. This is achieved through gathering data from a range of descriptive and predictive sources and applying them to the decision-making process. It enables teams to view the best course of action before making decisions, saving time and money while achieving optimal results.

Whilst each of these methods are useful when used individually, they become especially powerful when used together.

OneStream’s Approach to Predictive Analytics and Machine Learning

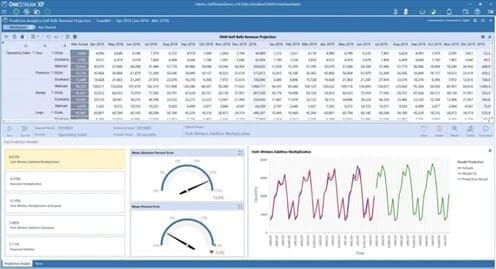

OneStream empowers Finance teams to lead at speed by unifying predictive analytics with core CPM processes: planning, budgeting, and forecasting; financial consolidation; reporting; and financial data quality. And with our built-in predictive analytics solution (see figure 2), OneStream is unleashing Finance transformation to take budgeting, planning, and forecasting processes even further – allowing teams to plan, analyze and predict with confidence.

As announced at OneStream’s Splash Virtual event in 2021, OneStream’s AI Services and Sensible ML solution will provide Finance teams with the power to leverage predictive ML models without extensive work by data scientists. This solution will take users through a step-by-step process for each part of the ML model-building and deployment process. Including feature engineering through advanced algorithm configuration, training, and deployment.

Learn more

Business Intelligence tools are part of a broader range of business analytics tools that include analytic data infrastructure, CPM and analytic applications, as well as advanced predictive analytic tools. These business analytics tools and applications are all designed to help organizations gather, organize, and disseminate information to executives and decision-makers and provide the “analytics intelligence” required to make timely and informed decisions that can drive improved business performance.

To learn more about OneStream’s approach to predictive analytics and machine learning, download our white paper, and contact OneStream if your organization is ready to transform Finance by aligning advanced predictive analytics and machine learning with core CPM processes.

Get Started With a Personal Demo